Hawsons Iron Ltd (ASX:HIO) is trading higher on agreeing to non-binding Letters of Intent (LOIs) for the offtake of up to 58 million tonnes per annum of high-grade Hawsons Supergrade® concentrate from the global steel sector.

The agreements come at a time of strong steel demand, with the company noting the pressure on the industry to decarbonise production.

Domestic, Asian and Middle Eastern Steel Mills account for 22 million tonnes and commodity traders make up the balance of demand, which puts Hawson’s in a strong position to meet some of that rising demand.

The offtake signals sufficient potential demand to support the scale-up of Hawsons Iron Project in Far West NSW to 20 million tonnes per annum.

Shares have been as much as 23.66% higher this morning to $0.115.

18 potential offtakers

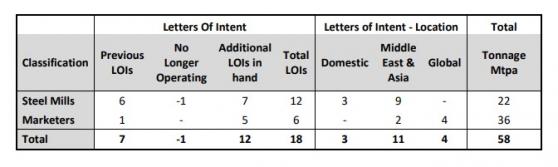

Hawsons has a list of 18 potential offtakers, predominantly targeting Asia and the Middle East, including 12 steel mill operators and six commodity trading houses.

There is also demand from mining companies for discussion on offtake when a bankable feasibility study (BFS) is completed or nearing completion.

“Significantly, we have been in discussion with representatives from several parties, including global mining groups, steel mill operators and commodity traders, who have also expressed investment interest to support development of our world-class Hawsons Iron Project near Broken Hill, when BFS information is more advanced,” Hawsons managing director Bryan Granzien said.

“This level of investment interest in the project and robust offtake demand is clearly a strong demonstration that making the transition to producing zero-emission ‘Green Steel’ is front and centre on the global steel industry’s planning horizon and that Australia is a preferred supplier of high-grade magnetite concentrate.”

Granzien believes potential demand was almost three times the project’s envisaged 20 million tonnes annual production rate before work on the BFS was slowed by a strategic review into scaling options could be undertaken in response to escalating capital expenditure costs.

“The strategic review work is narrowing the tonnage start-up and transport pathway options we have identified and the LOIs we now have in hand provide additional confidence that there is more than sufficient market demand to support a modular expansion plan to 20 million tonnes per annum,” he said.

While Hawson’s cannot name the offtakers due to commercial-in-confidence considerations, it has aggregated the demand: LOIs from steel mill operators account for 22 million tonnes of the total and marketers account for the 36 million tonnes balance.

Steel mill operators include existing operations and greenfield Direct Reduced Iron (DRI) steel mills being considered.

Read more on Proactive Investors AU