Results from a recently completed airborne radiometric and magnetic survey at GTI Energy Ltd (ASX:GTR, OTC:GTRIF)’s 100%-owned Green Mountain ISR Uranium Project in Wyoming, USA, have revealed 12 miles (19 kilometres) of new radiometric anomalies indicative of uranium trends.

Six prominent uranium anomalies were identified across the project area. These anomalies correlate with historically identified drill holes, interpreted trends, areas of past mining and/or known mineralisation.

The Green Mountain Project covers around 14,000 acres of underexplored mineral lode claims. The company has staked an additional 28 claims — based on the geophysical survey results — bringing the total holdings to 697 mining claims. The ground is contiguous with and expands the most easterly claim block at Green Mountain.

"Clear direction as to where to drill"

GTI Energy executive director Bruce Lane said: “The aerial geophysical survey has provided us with clear direction as to where to drill at Green Mountain.

“We have been able to utilise the historical drilling and geological information completed by Kerr McGee Corporation, Wold Nuclear and others during the 1970s and 1980s to help interpret and extrapolate significant additional anomalous uranium trends, particularly within the eastern part of the extensive Green Mountain land position.

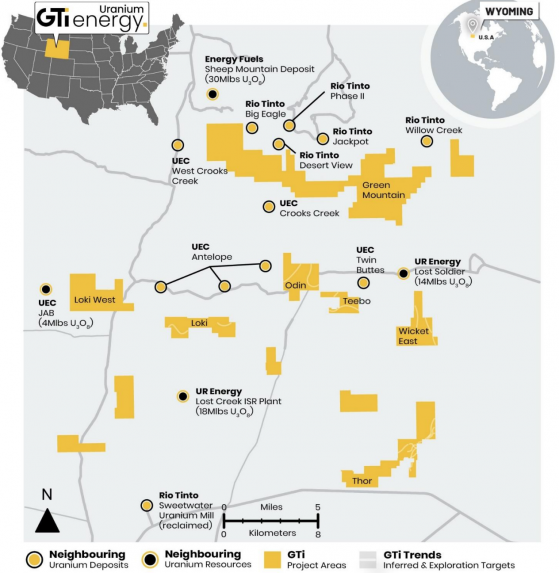

“The land package is surrounded by significant uranium deposits and resources owned by Rio Tinto (ASX:RIO), Energy Fuels (TSX:EFR), Ur Energy and UEC, so we know we are in an area with real potential. Our next step is to progress work on refining drill targets and permitting.”

USA uranium district

The project, in Wyoming’s prolific Crooks Gap/Green Mountain/Great Divide Basin uranium production district, is within a few miles of the company’s Great Divide Basin projects and within 60 miles of its Lo Herma project in Wyoming’s Powder River Basin.

The claims are south of Green Mountain, around 5-kilometres from GTI’s existing Odin claim group and within 15-kilometres of its Thor project where two successful drill programs were completed in 2022.

Nearby properties include Energy Fuel’s 30 million pounds Sheep Mountain deposit, Ur-Energy’s 14 million pounds Lost Soldier ISR deposit, UEC’s Antelope deposit and Rio Tinto’s Big Eagle (past producing), Jackpot, Desert View, Phase II and Willow Creek deposits.

Follow-up drilling ahead

The airborne geophysical survey followed up on the results of GTI’s previous historical drilling analysis and ground reconnaissance programs which highlighted high-quality exploration targets.

Work next year is likely to include refinement of drill targeting to generate an updated set of targets, and permitting with a view to potential drilling during mid to late 2024.

Current planning and budgeting are focused on developing a conceptual universe of 50 initial drill holes with an average drill depth of 1,500 feet.

GTI says the specific drill hole locations will need to be determined and field located and/or adjusted along with potential access routes in consideration of site-specific topography and potential environmental concerns, which will help prioritise and sequence holes.

Read more on Proactive Investors AU