GTI Energy Ltd (ASX:GTR) is off to a strong start in the hunt for uranium at the Thor in-situ recovery (ISR) prospect in Wyoming’s Great Divide Basin.

Two rigs are in operation over the uranium property, and GTI has checked off the first 25 holes in its 70-hole program, piqued to cover around 40,000 feet. Promisingly, 17 of the 25 holes drilled to date have met or exceeded the target uranium grade cut-off.

What’s more, GTI has encountered just under 2,000 feet worth of new mineralised roll fronts — a type of uranium-bearing groundwater deposit — to date, bringing the property’s total up to 19,470 feet.

Ultimately, GTI says the results to date meet expectations for economic ISR uranium recovery and confirm the historical data it’s using to guide the program.

What’s on the cards?

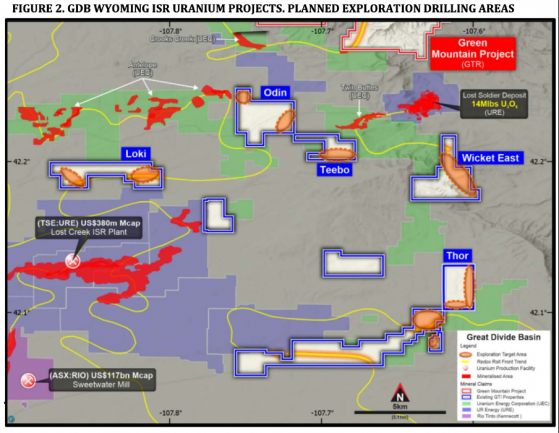

The uranium explorer hopes to complete the drill program at Thor within 20 operational days. Following that, the rig will move to complete 60,000 feet of drilling at the Odin, Loki, Teebo and Wicket East uranium prospects.

The program should wrap up by Christmas, giving GTI plenty of assay fodder as it plans its next steps at the 35,000-acre project.

GTI executive director Bruce Lane said results from the first 25 holes strongly justified the follow-up campaign at Thor.

“The historical drill maps combined with interpretation from our previous drilling have generated a high strike rate,” he explained.

“The mineralisation identified continues to show potential for ISR development as we extend our understanding of the roll fronts and work towards a resource report.

“We look forward to continuing exploration over the coming weeks and months when conditions for US domestic uranium, particularly in Wyoming, continue to strengthen.”

Program overview

Thor is the most advanced of the Great Divide Basin’s project areas.

It sits next to Ur-Energy Inc’s 18-million-pound Lost Creek uranium deposit and operating processing plant.

Exploration to date has successfully identified mineralisation with economic potential based on the reported widths, grades and depth.

As such, the program is planned, permitted and bonded to drill up to 70 new holes, targeting extensions along 2 miles of mineralised roll front identified during earlier drilling this year.

The new drilling will focus on the project’s northeast, including the two Wyoming state leases located northeast of the lode claim block, which GTI has previously explored.

Wicket East

Wicket East abuts the southern boundary of Ur-Energy’s Lost Soldier deposit.

Here, GTI plans to drill as many as 20 holes to explore a projected mineralised trend that extends from the southern boundary of URE’s Lost Soldier property.

This trend is thought to extend for roughly 3 miles, as defined by historical drilling information, similar in nature to that used to plan the maiden drilling program at Thor.

Odin, Loki and Teebo

The Great Divide project’s Odin and Teebo prospects are next to Uranium Energy Corp’s (UEC) Antelope Project, while the Loki claims sit south of UEC’s Antelope and north of URE’s Lost Creek.

GTI hopes to drill up to 40 holes across these prospects as it targets mineralised trends over a combined 5 miles.

Read more on Proactive Investors AU