GTI Energy Ltd (ASX:GTR) has secured vital intel on its newly staked Lo Herma Project, in Wyoming’s prolific Powder River Basin Uranium (CSE:NCLR, OTC:BURCF) district, in the form of a historical data package.

The data for Lo Herma comes with an estimated replacement value of around $15 million and includes drill logs for 1,445 drill holes, ranging over some 530,000 feet, and representing seven times the holes and around five times the area drilled by GTI to date in Wyoming.

Data sufficient for inferred resource

These historical drill logs show that there is sandstone-hosted uranium mineralisation with economic potential in the Powder River Basin’s productive Fort Union formation.

GTI believes sufficient historical data may exist to report an inferred mineral resource for Lo Herma by the end of the second quarter of the year, without further drilling.

Along with the data acquisition, the company has been active on the capital raising front with commitments received for a $2.3-million placement to fund Lo Herma’s development.

"Vastly improve understanding"

“We are delighted that we have secured a comprehensive historical drilling data package for the Lo Herma Project,” GTI executive director Bruce Lane said.

“The project area was extensively drilled during the 1970s and we estimate that it would cost GTI around $15 million and take a number of drilling seasons to replicate.

“The data will vastly improve our understanding of the project and is likely to dramatically accelerate progress towards reporting a uranium resource at Lo Herma – we believe that an inferred JORC mineral resource estimate may be reported at Lo Herma, without drilling, before the end of June this year.

“This would set GTI up for verification drilling during the Wyoming summer. We’re excited by the prospect of potentially being able to deliver a uranium resource in Q2 at the project in Wyoming’s most prolific production district.

“This is in addition to the resource definition work underway at our Great Divide Basin project, which is on track for a maiden resource report by the end of Q1.

“This comes at a time when market fundamentals for uranium continue to improve, especially for Wyoming producers.”

Significant ISR uranium district

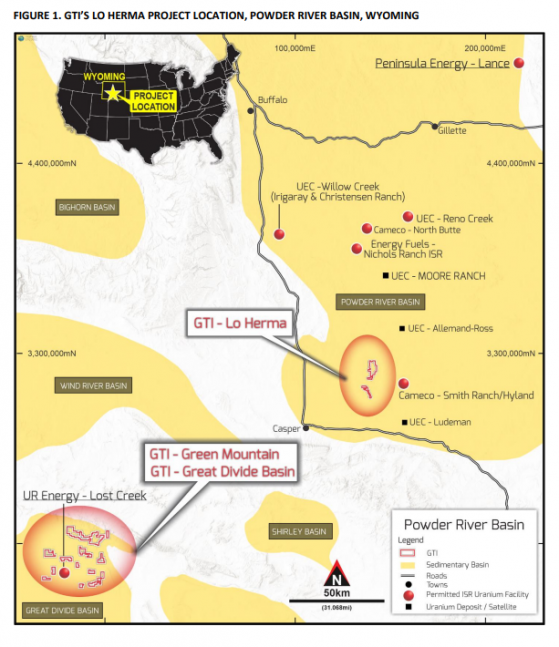

Lo Herma is in a significant position, with around 8,000 acres in Wyoming’s prolific Powder River Basin ISR uranium district.

The project is 10 miles from Cameco’s Smith Ranch-Highland ISR uranium plant – the largest production site in Wyoming – and within 100 miles of Peninsula Energy and Ur-Energy, which both plan to be back in production by April 2023.

Five permitted ISR uranium production facilities and several satellite uranium deposits are within 50 miles of Lo Herma.

These facilities include UEC’s Willow Creek (Irigaray and Christensen Ranch) and Reno Creek ISR plants, Cameco’s Smith Ranch-Highland ISR facilities and Energy Fuels Nichols Ranch ISR plant.

The Powder River Basin has an extensive ISR uranium production history and has been the backbone of Wyoming uranium production since the 1970s.

Cameco’s Smith Ranch-Hyland operation, with mineralisation hosted in the Fort Union Formation, has easily been the largest uranium production contributor in recent times.

Read more on Proactive Investors AU