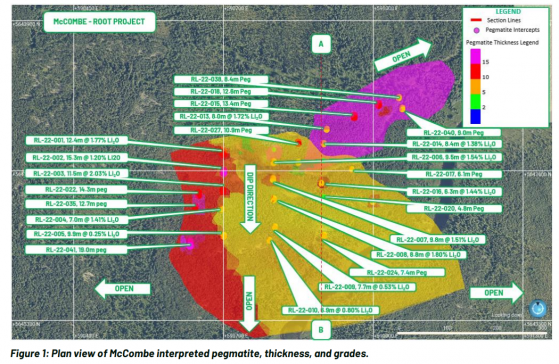

Green Technology Metals Ltd (ASX:GT1), a Canadian-focused multi-asset lithium business, has fielded further high-grade lithium assay results from its 100%-owned Root Project, 200 kilometres west of its flagship Seymour Project in Ontario, Canada.

The drilling at Root has been focused on the McCombe LCT pegmatite system, with the aim of delineating a maiden mineral resource estimate for this deposit.

Strong assays

Assays are in for a further five holes from the recently completed Phase 1 diamond program and include results such as:

- 8 metres at 1.72% lithium dioxide (Li2O) from 64 metres including 2 metres at 4.06% from 64.6 metres;

- 8.4 metres at 1.32% Li2O from 102 metres including 1-metre at 3.91%from 103.6 metres;

- 13.4 metres at 1.24% Li2O from 28.9 metres including 1-metre at 3.16% from 29.3 metres; and

- 6.3 metres at 1.52% Li2O from 66.3 metres including 1-metre at 2.38% from 70.7 metres.

The McCombe LCT (lithium-caesium-tantalum) pegmatite is the most advanced prospect at the Root Project.

To date, 31 holes have been drilled at McCombe, with two diamond drill rigs operating around the clock.

The two-phase program consists of Phase 1 definition drilling for 22 holes and Phase 2 extensional drilling for a further nine holes.

Phase 2 is in progress, with strong visual spodumene logged in pegmatite intercepts. The company is still awaiting further assay results.

“Recent assay returns have confirmed that McCombe is higher grade than originally interpreted based on historical data,” said CEO Luke Cox.

“The Root Project as a whole is also developing into a much larger complex, with McCombe potentially joining with Morrison to form a structure over several kilometres long, and recent spodumene discoveries at Root Bay confirming it extends east and west along a magnetic high.”

Simpler mineralised system

Historical drilling completed by previous owners from 1950 to 2016 intersected numerous pegmatites, generally dipping to the south and striking east-west.

Phase 1 and Phase 2 drilling by GT1 has now demonstrated McCombe to be a much simpler mineralised system: one major pegmatite averaging 10 metres in thickness, striking east-west with shallow dip approximately 30 degrees to the south, and a second pegmatite striking northeast with similar thickness.

The average grades, spodumene crystal size and crystal mass returned in the recent drilling at McCombe correlate well with the historical down dip continuity drill hole completed in 2016, which intercepted 67 metres at 1.75% Li2O.

A second similar pegmatite has been intersected at the mid-point of the main pegmatite striking northeast and dipping to the southeast, with further targeted drilling set to extend this pegmatite to its natural limits.

There are hopes that McCombe might join up with the Morrison pegmatite system to form a structure several kilometres long.

Next up, GT1 plans to begin environmental baseline surveys and the permitting process.

Estimation of a maiden Root mineral resource remains on track for the first quarter of 2023.

Read more on Proactive Investors AU