Canadian-focused multi-asset lithium business Green Technology Metals Ltd (ASX:GT1, OTC:GTMLF) has completed its preliminary economic assessment (PEA) for its vertically integrated lithium business in Ontario, Canada, featuring vertically integrated mines, concentrators and a lithium hydroxide conversion facility.

The company also confirms that a mining lease has been granted over the proposed Seymour mine construction area for a 21-year term.

Compelling project economics

The PEA validates the company's potential to emerge as a large-scale, cost-effective producer of lithium concentrates and chemicals, emphasising environmentally sustainable production of SC5.5% spodumene concentrate and lithium hydroxide.

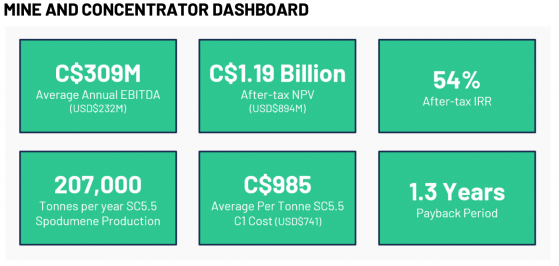

The combined mine and concentrator development delivers a net present value (NPV) for the project of CAD$1,189 million (A$1,335 million). The project’s compelling projected economics are due to attractive capital and operating costs, short transportation distances, minimal royalties and low corporate income taxes.

The PEA draws on the mineral resource estimates of the Seymour Lithium Project, amounting to 10.3 million metric tons at 1.03% lithium oxide, and the Root Lithium Project, with a resource of 14.6 million metric tons at 1.21%.

GT1 chief executive officer Luke Cox said: “We are pleased to deliver our PEA which initially includes the mines and concentrators in northwestern Ontario, confirming a strong NPV and robust project delivery strategy with low capital hurdles to get GT1 first into production within the province of Ontario.

"The second part of the PEA includes the conversion of lithium concentrates to lithium chemicals which are currently unavailable in North America and will play a critical role in closing the supply chain from mine to electric vehicle, all Ontario made.

“The success of GT1’s strategy includes collaboration between Indigenous partners, communities, government, industry, and all stakeholders. Working together, the actions in this strategy will build a stronger, more resilient business and promote local communities.”

Two development options

The PEA analysis considers two project development options — both emphasising the generation of substantial net cash flows throughout the life of mine that will fund subsequent stages of the project. Both options are independently feasible.

Combined Seymour and Root mine and spodumene concentrators

The first option involves producing saleable spodumene (SC5.5%) from the Seymour and Root mines and concentrators without the converter, covering 15 years of mine/concentrate feed exclusively from the 100%-owned projects.

As per the PEA, this option delivers after-tax NPV of CAD$1,189 million (A$1,335 million), IRR of 54%, total life of mine revenue of CAD$7,958 million (USD $8,936 million), with start up capex of CAD$1,064 million (A$1,1948 million).

Integrated lithium project – mine, concentrators and chemical conversion facility

The second option encompasses an integrated project of the mines, concentrators, and a lithium hydroxide conversion facility. This option is currently designed for a 15-year life of mine confined to the current mineral resource estimates for both the Seymour and Root projects.

This option would deliver after-tax NPV of CAD$1,506 million (A$1,691 million), IRR of 27%, total life of mine revenue of CAD$14,230 million (A$15,979 million), with start-up capex of CAD$1,064 million (A$1,194 million).

The company believes in the continual growth of the mineral resources in the coming years, driven by both organic and inorganic expansion. This growth is anticipated to secure additional years of feed to both concentrators and the proposed lithium hydroxide conversion facility, primarily sourced from the company's proprietary mines extending the project’s lifespan.

Seymour permitting and approvals

The permitting process continues on schedule, with the recent grant of the mining lease for the Seymour Lithium Project from the Department of Mines for a period of 21 years. The mining lease covers the proposed mining and processing construction areas of the project and is a prerequisite before any project development activities.

The company says the granted mining lease for Seymour represents a significant achievement in derisking the project on the path toward development and production.

Read more on Proactive Investors AU