Green Technology Metals Ltd (ASX:GT1) has inked a binding agreement with Ardiden Limited to purchase the residual 20% free-carried interest in the Ontario Lithium Projects held by Ardiden, bringing the company’s ownership in the suite of projects to 100%.

Ardiden will receive $16 million in cash in return, with a further milestone payment of $2.5 million payable upon confirmation of a JORC-compliant mineral resource of more than 20 million tonnes across the projects.

“We are very pleased to have agreed this consolidating transaction across our Ontario Lithium Projects tenure,” Green Technology Metals CEO Luke Cox said.

“To have secured 100% ownership of our key assets, including our flagship Seymour Mine Development, further cements our strategic industry positioning.

“It also removes the implicit economic burden of a free-carried minority interest over these assets.”

Rapid progress across Ontario projects

“It is full steam ahead at GT1,” Cox continued, “We are drilling intensively at both Seymour and our Root project.

“We are also undertaking multiple metallurgical test-work programs, alongside all our environmental and permitting baseline work, as we rapidly progress the requisite preliminary economic assessment (PEA) workstreams for Seymour.

“Finally, we remain attuned to potential further project and/or strategic transactional opportunities within Ontario, and more broadly.”

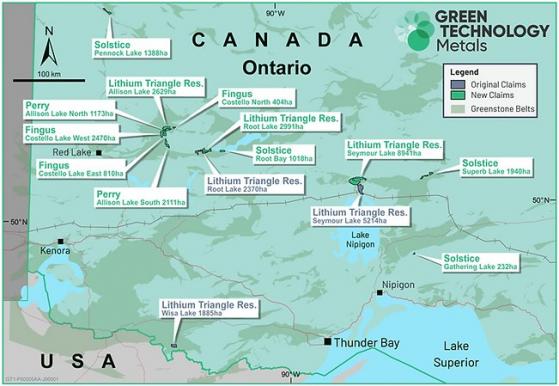

Green Technology Metal’s Ontario Projects.

“Key outcomes from these activities are set to flow over coming months, including ongoing drilling and assay results, a further resource update at Seymour, a maiden resource estimate at Root, and scheduled completion of the Seymour PEA, including downstream facility development, in H1 2023,” Cox said.

“All of this is set to occur against an ongoing backdrop of aggressive governmental and end-user incentivisation of new North American domiciled lithium supply sources, including via the recent game-changing Inflation Reduction Act 2022 legislation in the US.”

Read more on Proactive Investors AU