Green Technology Metals Ltd (ASX:GT1) says its Root Bay lithium deposit continues to shine following the latest batch of high-grade lithium hits.

Assays from another 26 diamond drill holes at the Root Project in Ontario, Canada, have delivered the best drill result to date - a 17.6-metre intersection, grading 1.77% lithium oxide from 195.5 metres.

Other strong results include:

- 17.4 metres at 1.6% lithium oxide from 110.8 metres;

- 16 metres at 1.71% from 100.9 metres;

- 17 metres at 1.55% from 296 metres;

- 14.6 metres at 1.76% from 223.6 metres;

- 13.5 metres at 1.65% from 181.7 metres; and

- 12.9 metres at 1.62% from 317.5 metres.

So far, GT1 has completed 78 holes and more than 12,800 metres of drilling, meaning it’s just beyond the halfway mark in its 22,000-metre exploration campaign.

Results are pending for 42 holes — assays from which will underpin a mineral resource update at Root Bay early in Q4.

Ahead of the update, GT1 hopes to complete infill drilling by the end of the month to boost confidence in the deposit’s maiden 8.1 million tonnes inferred resource, which forms a sizeable portion of the company’s 22.5 million tonnes global lithium resource base.

CEO Luke Cox said: “The infill diamond drilling program is now over 50% complete at Root Bay and we are pleased to see the continued consistent high-grade results, providing confidence in our maiden resource estimate.

“We are looking forward to receiving the remaining drill results at Root Bay and releasing our updated mineral resource estimate in the fourth quarter of 2023.”

The road ahead

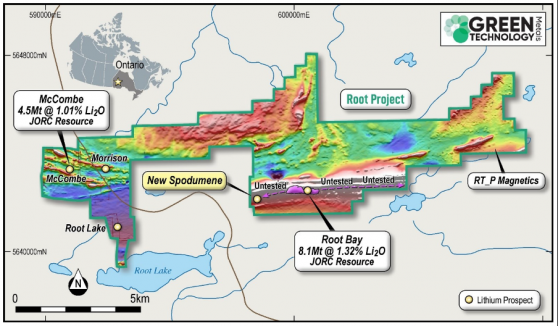

GT1’s Root Project is home to multiple pegmatite deposits and two standalone resources; the 8.1 million tonnes estimation at Root Bay and a 4.5 million tonnes lithium base at the McCombe prospect.

Exploration prospects at the Root Project.

The former deposit has been the focus of GT1’s multi-phase exploration campaign, designed to prove up existing resources and identify new priority drill targets to Root Bay’s east and west.

From June through to August, the lithium stock has executed infill drilling and field exploration in both directions, as well as over the North Root tenement area.

Between September and October, focus will shift to extensional drilling over a highly prospective 3-kilometre zone before GT1 rounds out the year with exploration drilling over its priority targets.

In the meantime, the explorer continues to prospect to Root Bay’s east and west, where thinner overburden means basement rock can be easily identified.

This work is already reaping rewards; GT1 has made a new lithium-caesium-tantalum pegmatite discover 1.4 kilometres along strike and west of the deposit, extending its mineralised trend to more than 2.7 kilometres.

To date, the company has collected 29 samples from this trend, with more results expected in the coming weeks.

While it’s still early days, anomalous lithium either side of the deposit looks like a prime target for GT1’s imminent exploration campaign.

Root Bay rock chip samples.

Read more on Proactive Investors AU