Green energy alternatives to fossil fuels and hydrocarbons have become ever more vital as the energy transition accelerates while also offering opportunities for states to secure their energy security on a local level without the need for costly and vulnerable international supply chains.

State of the market

Hydrogen

“Hydrogen is today enjoying unprecedented momentum. The world should not miss this unique chance to make hydrogen an important part of our clean and secure energy future.” - Dr Fatih Birol, executive director of the International Energy Agency.

In 2019 the Government of Japan commissioned a landmark hydrogen report from the International Energy Agency (IEA), which found that hydrogen is: “currently enjoying unprecedented political and business momentum, with the number of policies and projects around the world expanding rapidly”.

It concludes that now is the time to scale up technologies and bring down costs to allow hydrogen to become widely used.

Until recently, hydrogen demand was driven predominantly by the refining and chemical sectors of industry but the IEA estimates that by the end of this year, demand for hydrogen could reach as high as 180 million tonnes, with nearly half of that generated by new applications, particularly in heavy industry, power generation and the production of hydrogen-based fuels.

Research carried out by McKinsey and Company, a global management consulting firm, indicates demand could reach as high as 600 to 660 million tonnes by 2050, potentially offsetting some 20% of global emissions.

At present, the global hydrogen generation market is expected to grow from US$160 billion in 2022 at a compounding annual growth rate (CAGR) of 10.5% to some US $263.5 billion in 2027, according to Markets and Markets.

While hydrogen is still positioned as a promising potential disruptor rather than a wholesale replacement for hydrocarbons, the potential of the gas as an energy source and fuel can’t be denied.

Solar

The generation of energy through solar photovoltaic (PV) technology, or solar power, reached new records in 2021, increasing by 179 terawatt-hours (TWh) to exceed 1,000 TWh in energy.

It’s quickly becoming one of the lowest-cost forms of new electricity generation the world over, falling from A$135 per megawatt-hours (MWh) to as low as A$44.50/MWh – a massive saving compared to the average price of electricity in Australia, which currently sits at about A$0.25-A$0.40 per kilowatt-hour or A$250 to A$400 per MWh.

The global solar power market was valued at US$167.83 billion in 2021 and is expected to grow at a CAGR of 6.9% to reach US$373.84 billion by 2029.

Fortune Business Insights says: “If appropriately exploited, this highly distributed source has the prospective to meet all demands of future energy.

“Over the past years, solar energy has proved to be an important renewable energy source due to its limitless availability and environmentally friendly nature.

“The increasing concern to reduce the dependency on fossil fuels and minimise carbon emissions from burning them has propelled the demand for renewable energy and its sources.

“This factor is expected to drive the development of these markets during the forecast period.”

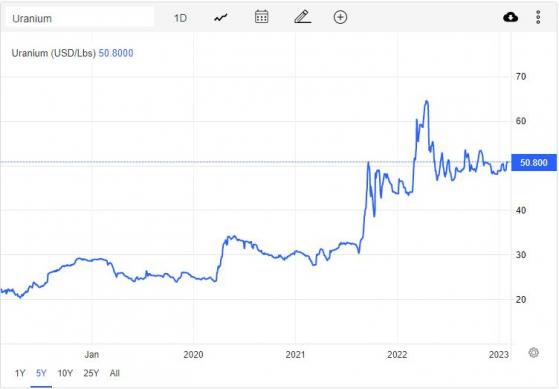

Uranium isn’t traded on the open market like other commodities. Buyers and sellers generally negotiate contracts privately and prices are published by independent market consultants.

The uranium spot price finished the December 2022 quarter at US$48.88 per pound and has since fluctuated between US$48 and US$51/pound.

Trading Economics: Uranium spot price as of 2/02/23.

The softening in the uranium spot price is a result of “a decline in coal and natural gas prices reducing the urgency for alternative energy sources”, according to Trading Economics.

Despite the softening, the outlook remains positive: “Volatile energy markets and carbon-cutting goals continued to support demand for nuclear fuel.

“The US Department of Energy purchased 300,000 pounds of uranium oxide, kicking off its earlier solicitation to buy 1 million pounds with up to US$75 million in contracts for the strategic uranium reserve.

“Among other major players, Japan ordered the development of new power plants and approved the restart of 17 shut-down reactors, marking a historical pivot of confidence in the sector since the 2011 Fukushima meltdown.

“Furthermore, China's nuclear authorities expanded construction capacity to raise their power plant building objectives to 10 new reactors per year.”

There are also plans for new reactors in India, Russia, South Korea, Turkey, Bangladesh and the UK, among many other nations.

Find more statistics at Statista.

In the spotlight: ASX Green Energy stocks

Now, let’s look at some ASX stocks that made progress in the Green Energy market this quarter.

HyTerra

HyTerra Ltd (ASX:HYT) listed on the ASX last quarter, raising some $5.8 million as part of its IPO at $0.02 per share and preparing for flow test operations on the Hoarty NE3 natural hydrogen exploration well at Project Geneva in Nebraska, US.

HyTerra is targeting natural hydrogen production close to end users and markets in the United States, going straight to the source for emission-free hydrogen without the need for energy-intensive electrolysers.

The company is developing Project Geneva in a joint venture with Natural Hydrogen Energy LLC and has already engaged service providers for well testing in the first quarter of 2023.

Flow testing of the Hoarty NE3 well will be an important proof-of-concept opportunity for the company, which intends to establish the hydrogen production potential of the well and measure key parameters that include gas composition, pressure and flow rate.

Provaris Energy

Provaris Energy Ltd (ASX:PV1) made broad regulatory progress for its compressed hydrogen carrier technology, securing front-end engineering design (FEED) approval from the American Bureau of Shipping (ABS) for the 26,000-cubic-metre H2Neo Carrier.

The company has since secured a collaboration agreement with Norwegian Hydrogen AS to jointly develop green hydrogen supply chain projects in the Nordic region, including Norway as an origin of supply, with a focus on supply to key European ports.

Provaris will now turn its attention to the shipyard selection process this year, targeting the execution of shipbuilding contracts for the H2Neo within 2023, to be available for large-scale hydrogen shipping in 2026.

“Achieving world-first Design Approval from ABS (a recognized IACS member) for a bulk compressed hydrogen marine carrier is a critical de-risking milestone for the company as we continue to align our technical program with delivery of commercial opportunities now advancing for Provaris,” Provaris Energy managing director and CEO Martin Carolan said.

“Provaris has seen a step-change in the interest from industrial partners to unlock the challenges of storage and transport within the hydrogen value chain, with opportunities in Asia to run in parallel with our recent collaboration announcement for the development of hydrogen value chains in Northern Europe.

“The application of compressed hydrogen to transport gaseous green hydrogen within regional proximity of demand locations is an obvious pathway and we are confident the simplicity and flexibility of our compressed H2 supply chain can provide a cost-competitive solution this decade and a solution that is aligned with ramp-up volumes of hydrogen demand near term.”

Frontier Energy

Frontier Energy Ltd (ASX:FHE) has been hard at work developing the Bristol Springs Green Hydrogen Project in Western Australia, where FHE intends to build a 114-megawatt solar farm to power a 36.6-megawatt electrolyser.

The company completed a pre-FEED study during the quarter, outlining estimated capital costs of about $71.7 million and direct operating costs for the hydrogen production facility of $2.89 million per year.

FHE also signed a collaboration agreement with Waroona Energy, a company building a 241-megawatt solar farm adjacent to the Bristol Project, to leverage additional strategies for energy production.

Importantly, the Western Australian Government awarded the Bristol Project 'Lead Agency Status', recognising its importance to the development of the renewable energy industry in Western Australia.

Toward that end, Hydrogen Australia, a division of the Smart Energy Council, has begun the pre-certification process at Bristol, assessing the project’s capacity to produce carbon-neutral renewable hydrogen.

ClearVue Technologies

ClearVue Technologies Ltd (ASX:CPV, OTCQB:CVUEF) expanded its board and management team last quarter, preparing for a planned expansion of the company’s operations with a new bookkeeper, project manager and global business development director.

CPV also broke into the skylight market for its proprietary photovoltaic solar glazing technology, securing a residential installation contract with a luxury residence in the ACT.

Skylights and similar 'roof window' applications offer an attractive commercialisation opportunity for ClearVue’s technology, with the potential for refurbishments and new projects across the residential property market.

On the more industrial side of things, CPV’s product is now being tested at Singapore’s Building and Construction Authority (BCA) world-leading Skylab facility.

The purpose of the tests is to determine the performance of ClearVue PV glazing under real-world conditions and for various orientations for each of energy performance; BIPV performance; thermal performance; and daylighting performance.

Finally, CPV received a $812,500 research and development tax credit through the Commonwealth Government Research & Development Tax Incentive Program for the company’s work on solar and greenhouse technology among a range of other R&D activities.

Alligator Energy

Alligator Energy Ltd (ASX:AGE) is focused on the Samphire Uranium Project, which the company intends to convert into an in-situ recovery (ISR) operation.

Leach tests on Samphire uranium have been very successful, with performance results in the 92-96% range during the Australian Nuclear Science and Technology Organisation’s (ANSTO) testing.

AGC is focused on incorporating this data, alongside updated capital and operating cost estimates, into scoping study models.

The company is also preparing for a short-duration ISR field recovery test (ISR-FRT) on the Blackbush deposit in late 2023, which will provide important proof-of-concept data for the uranium project.

In the meantime, Alligator will pursue resource expansion activities to increase the project’s mineral resource estimate beyond the current estimate of 14.8 million pounds of uranium at a 250 parts per million (ppm) cut-off grade.

Cauldron Energy

Cauldron Energy Ltd (ASX:CXU) holds several uranium, base metal and gold assets, including one of Australia’s largest uranium deposits in the form of the Bennet Well Deposit, host to 30.9 million pounds of uranium at a 150 ppm cut-off.

The company also holds 51% of the Blackwood Gold Project, the Yanrey Uranium Project and several industrial bulk sand assets in Western Australia.

CXU is awaiting an overturn of a 2017 restriction on uranium mining in Western Australia, put in place by the McGowan Labor Government.

The company believes this change in policy is fairly likely given the growing focus on clean energy and carbon neutrality in the international community.

In the meantime, Cauldron is leveraging its sand assets to explore for product suitable for the construction and reclamation industries.

The company’s assets are in varying stages of development, but CLE does have a stockpile of already mined sand material capable of near-term supply.

Eclipse Metals

During the quarter, Eclipse Metals Ltd (ASX:EPM) completed a maiden round of percussion drilling and trench sampling at the 50-kilometre-square Ivigtût mine precinct and Grønnedal carbonatite in southwest Greenland.

The program was designed to collect sub-surface samples of the rare earth element (REE) bearing carbonatite formation and to obtain samples of mineralised waste from the Ivigtût mine.

As exploration continued in Greenland, Eclipse is also advancing its uranium projects in Australia’s Northern Territory, working on ethnographic surveys and access agreements with the Northern Land Council and Central Land Council.

Overall, Eclipse holds about 120 square kilometres of uranium-prospective tenements and a further 11 square kilometres of manganese-prospective assets in Queensland.

GTI Energy

GTI Energy Ltd (ASX:GTR) completed an expansive 30,000-metre drilling campaign across its Great Divide Basin (GBD) Uranium ISR Project in the December quarter, designed to produce data for a mineral resource or exploration target estimate for the tenure.

GTR completed 103 holes across the Thor, Odin, Teebo and Loki prospects, revealing 4.2 kilometres of roll front trends prospective for uranium.

The company also identified a new roll front trend within lease section 29, making for more than 12 kilometres of total projected roll front trends.

Importantly, of 33 holes drilled at Odin, Teebo, and Loki, 29 holes encountered uranium mineralisation, and mineralised fronts appear to be conducive to in-situ recovery as the water table sits some 30-60 metres above the host sands.

Lotus Resources

Lotus Resources Ltd (ASX:LOT) remained focused on the resumption of operations at the Kayelekera Uranium Project in Malawi during the quarter, meeting with several companies and consultants in relation to a pre-restart FEED study and offtake negotiations.

The company also made progress on a non-binding term sheet with the Government of Malawi, with UK-based lawyers appointed by the government engaged to complete the legal process, and released an annual sustainability report.

On the exploration side, LOT undertook greenfield exploration drilling for uranium at the Chilumba Uranium Prospect, some 8 kilometres from the existing Livingstonia deposit.

Results highlighted the potential for several more uranium discoveries in the region, which Lotus considers underexplored.

Read more on Proactive Investors AU