Gold continues to flow from Great Boulder Resources Ltd (ASX:GBR)’s Side Well Project, where reverse circulation (RC) analysis on the Mulga Bill prospect has turned up more “spectacular” results.

The precious metals explorer released fire assays this morning, confirming the high-grade gold reported during recent RC work at the West Aussie exploration hub with investors responding positively, pushing shares up 14.94% in early trading to $0.10.

With gold readings up to 3,160 g/t at hand, Great Boulder managing director Andrew Paterson said the team was excited to get back to RC drilling at Mulga Bill once its aircore program wrapped up.

GBR is further galvansied by its recent A$5 million capital raise, which will support exploration across the Side Well and Wellington projects.

Results are in

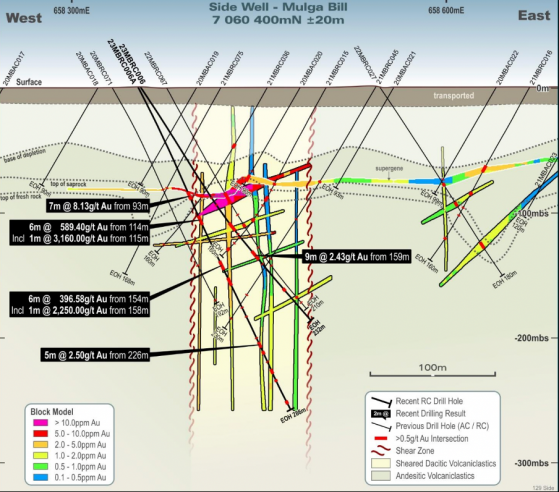

Early this year, GBR drilled 13 holes, encompassing nearly 4,000 metres, during a phase one RC program at Mulga Bill.

The campaign was designed to test for gold along Mulga Bill’s Central and HGV zones, and samples for two visible gold hits underwent Photon assessment at the time.

Fast forward to today, and fire assay work on hole 23MBRC006A (which returned the visible gold) confirmed intersections like:

- 7 metres at 8.13 g/t gold from 93 metres;

- 6 metres at 589.44 g/t from 114 metres, including 1-metre at 3,160 g/t from 114 metres and 1-metre at 366 g/t from 115 metres; and

- 6 metres at 396.58 g/t from 154 metres, including 1-metre at 2,250 g/t from 158 metres and 1-metre at 94.4 g/t from 159 metres.

Assays from hole 23MBRC006A.

GBR was also pleased with hole 23MBRC008, which reported:

- 4 metres at 22.1 g/t gold from 184 metres; and

- 19 metres at 12.83 g/t from 229 metres, including 2 metres at 112.4 g/t.

Assays from hole 23MBRC008.

Assays are in the pipeline for another three holes, but there’ll soon be more to report from the field: GBR is back on ground for RC drilling in mid-April, while aircore work continues along the Mulga Bill corridor.

Aircore results imminent

Paterson was pleased to recap the fire assays today — findings that underscore Mulga Bill’s recent high-grade results.

“While the spectacular visible gold intersections in 23MBRC006A have garnered plenty of attention it’s great to see the new deep high-grade zone in hole 23MBRC008,” he explained.

“The Challenge Drilling RC rig will be back on site in the second week of April for a follow-up program at Mulga Bill and Ironbark. By that time, we will also have results coming through from the aircore program within the 6-kilometre Mulga Bill corridor.

“The GBR field team is continuing its busy start to the year at Side Well, and we expect a consistent stream of news flow from ongoing programs over the months ahead.”

What’s new at Wellington?

Roughly 500 kilometres east of Side Well in the Earaheedy Basin, GBR is also preparing for fieldwork at its Wellington zinc-lead project.

The company signed an Aboriginal heritage agreement in 2022, and now it’s preparing for an initial heritage survey over the 1,134-square-kilometre tenement.

GBR will chase the survey work with a wide-spaced soil Geochem program — work that could provide impetus for an aerial gravity survey down the line.

Based on a looming geochemical target that’s similar to Rumble Resources Ltd (ASX:RTR)’s large-scale Chinook discovery, Great Boulder believes this region boasts the hallmarks of a world-class Mississippi Valley-type zinc-lead province.

Read more on Proactive Investors AU