Great Boulder Resources Ltd (ASX:GBR) has resumed aircore drilling at its flagship Side Well Gold Project near Meekatharra in Western Australia while it awaits first assays from recent diamond drilling at Ironbark and Mulga Bill.

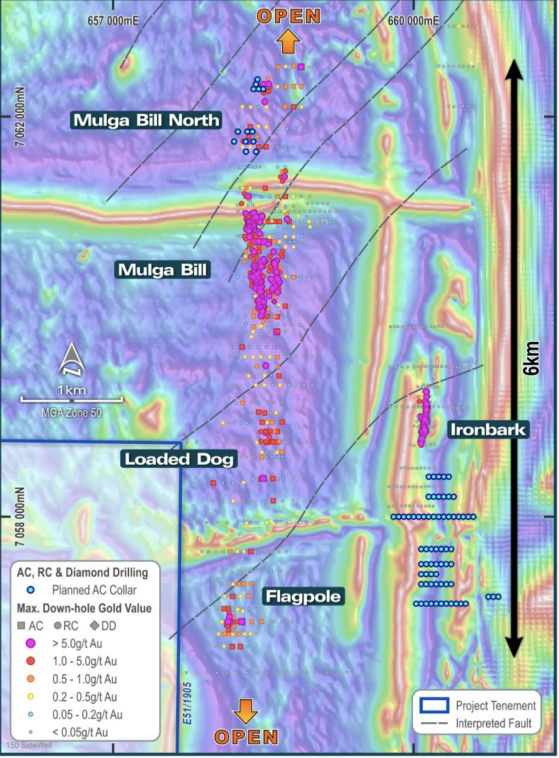

GBR will undertake around 4,000 metres of aircore drilling to test two priority targets along strike to the south of Ironbark and in the Mulga Bill North area.

“The Great Boulder field team is back in action testing two priority target areas," Great Boulder’s managing director Andrew Paterson said.

"Drilling south of Ironbark will test mineralisation along strike as well as some untested geochemical anomalies.

"At Mulga Bill North we have a series of holes testing the 700 metres mineralised zone outlined by previous drilling."

A 4000m AC program will test areas at Ironbark South and Mulga Bill North.

Well positioned for busy second half

Paterson said the debt-free company with $6.5 million in the bank, was poised for a busy second of the year, with assays, drilling and cultural heritage surveys all running in parallel.

“The first assays from recent diamond drilling at Ironbark and Mulga Bill should start trickling through within the coming fortnight, so we expect to have more updates shortly,” he said.

“We are also working in parallel to progress cultural heritage surveys over the broader Ironbark corridor as a priority for upcoming exploration programs.

“Great Boulder is well positioned for an extremely busy second half of 2023 as we look to start testing a range of exciting targets within the 14-kilometre-long Ironbark hydrothermal gold system. This will underpin the company’s drilling programs as we work to define Side Well’s million-ounce potential.”

The Side Well Gold Project in the Murchison gold field has an inferred mineral resource of 6.192 million tonnes at 2.6 g/t gold for 518,000 ounces.

Cultural heritage surveys and top targets

GBR has initiated cultural heritage surveys to be performed by the representatives of the Yugunga Nya group across an approximately 14-kilometre range on the Ironbark corridor.

This significant stretch encompasses several high-priority prospect areas, which GBR anticipates will form a substantial segment of its exploration pipeline for FY24 (see below).

The company is eager to uncover new Ironbark-style, near-surface, high-grade gold deposits in this zone.

Auger sampling has delineated a 14-kilometre hydrothermal gold system, which is situated along the Ironbark stratigraphy on the eastern flank of Side Well.

Several top priority targets have been identified in areas featuring more prominent gold and bismuth auger anomalies than those found in Ironbark. This, in turn, suggests that these zones may harbour larger-scale mineralised systems.

In late June, GBR launched a Sub-Audio Magnetics (SAM) survey, focusing on a 2-kilometre vicinity centred on the Ironbark deposit. The survey aims to offer high-resolution imagery of the magnetic and electrical properties within the immediate Ironbark location.

The collected data will likely enhance understanding of the factors influencing mineralisation at Ironbark, thereby informing future drill targeting around the resource and similar prospects elsewhere.

Upon obtaining heritage clearances for the broader Ironbark trend, GBR plans to embark on a large-scale aircore program to test priority targets. This step will be followed by a campaign-based reverse circulation (RC) drilling initiative.

Read more on Proactive Investors AU