A new copper and silver exploration target is taking shape at Great Boulder Resources Ltd (ASX:GBR)’s Mulga Bill prospect, part of the Side Well Gold Project in WA’s Murchison district.

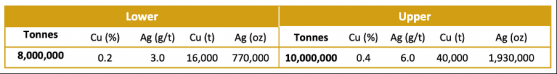

The conceptual target ranges from 8 million to 10 million tonnes, estimated to host between 0.2% and 0.4% copper for up to 40,000 tonnes of the critical mineral.

GBR believes the discovery, revealed through retrospective drill hole assaying, positions Mulga Bill as a major contributor to its portfolio.

Using visual observations and pXRF data, the explorer has made a list of some of the most prospective copper-gold-silver zones, buoyed by drill results like 55 metres at 0.75% copper, 2.72 g/t gold and 7.6 g/t silver from 100 metres.

Next steps

Great Boulder is actively collecting copper and silver assays from drill holes along roughly 380 metres of strike, determined to put numbers to the mineralisation that could enhance a future gold mine at Side Well.

Interestingly, the newly discovered copper and silver partially overlaps with gold defined in the 518,000-ounce Side Well resource, announced in February 2023.

That means there’s further impetus to include the latest assays in the next mineral resource update, proving up the range of commodities on the table at Mulga Bill.

What about the gold?

Great Boulder managing director Andrew Paterson said the Mulga Bill exploration target had been months in the making, amalgamating past and present findings to build an accurate profile.

“We’ve now compiled a significant data set which underpins the exploration target expectations,” he stated.

Paterson also clarified why the exploration target was yet to factor in a potential gold endowment, noting there were two different data populations at Mulga Bill.

“The high-grade cross-cutting veins contrast with bulk tonnage low-grade gold mineralisation within the copper sulphide lodes, so we are treating both styles of mineralisation separately at this stage.

“Once the gold, copper and silver data is compiled into a formal resource estimate. we will be able to quantify the different styles of mineralisation.”

With two out of three minerals counted in the target to date, Paterson concluded the Mulga Bill footprint could add substantial value to a future production scenario.

Read more on Proactive Investors AU