Great Boulder Resources Ltd (ASX:GBR) is testing the potential of the Polelle Gold Project near Meekatharra, Western Australia, in which it hopes to acquire a controlling share if exploration activities are fruitful.

Under an agreement with Castle Minerals Ltd, Great Boulder has the option to pick up 75% of Polelle.

Assays are in

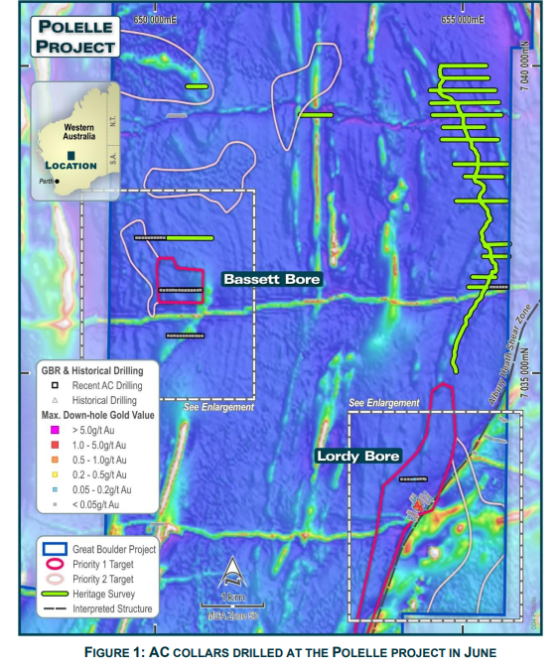

The June drilling program involved 45 aircore holes across 1,764 metres, limited to four lines of shallow drilling – and assay results are now in.

The drilling targeted areas in the northwest and eastern parts of the project and stayed within heritage clearances completed by Castle Minerals in 2022.

While no significant gold was intersected, multi-element assays confirmed strong pathfinder anomalism, validating GBR's targeting model.

Antimony values ranged from 11 parts per million (ppm) to 55 ppm at Lordy Bore and up to 12 ppm in the northwest near Bassett Bore. As a point of comparison, the median value for antimony in Archaean rocks is 0.3 ppm.

These values were accompanied by elevated levels of arsenic, copper, bismuth, tellurium, molybdenum and lead.

Some anomalies were associated with a carbonaceous black shale, which can concentrate pathfinder elements through carbon scavenging. A complex sequence of mafic to intermediate rocks nearby also showed elevated pathfinder elements, marking the area as a target for further exploration.

In early July, Great Boulder received a A$558,000 research and development rebate, which it will channel into ongoing exploration efforts such as ongoing aircore drilling at the Side Well Gold Project, with the rig extending coverage at Mulga Bill North.

Next steps

Next on the agenda is a heritage survey for Polelle to clear drill lines over priority target areas.

Following heritage clearance and government program approvals, the next round of aircore drilling will provide a more comprehensive assessment of Polelle's potential.

The exploration team is also advancing drilling at Side Well, with programs underway or planned for Mulga Bill North, Mulga Bill, Saltbush and Side Well South.

Managing director Andrew Paterson said: “We completed four lines of drilling in two areas at Polelle based on heritage surveys by Castle Minerals in 2022.

"Unfortunately, that meant the program wasn’t optimal in terms of our priority targets, but we confirmed very high levels of antimony and other pathfinders in both locations.

Inside the mineralised system

“Antimony is one of our key pathfinder elements for orogenic gold deposits and it confirms we’re inside the mineralised system. We are planning a heritage survey shortly to clear the priority targets prior to our next drilling program.

“In the meantime, it’s all systems go at Side Well, with aircore and reverse circulation (RC) drilling testing a range of targets from Mulga Bill North down to the southern end of the project.

“The second half of the year is going to be extremely busy and we anticipate a lot of good news in the months ahead.”

Read more on Proactive Investors AU