Grayscale Investments, manager of the market’s largest bitcoin fund, is being sued by Fir Tree Capital Management, according to a Bloomberg report.

Fir Tree wants Grayscale to allow shareholder redemptions, something the trust does not allow, meaning investors are forced to sell their shares at a large discount to a dwindling pool of potential investors.

Grayscale’s 850,000 investors have been “harmed by Grayscale’s shareholder-unfriendly actions,” says Fir Tree, which also wants Grayscale to cut its 2% free rate.

Another source of ire is the fact that Grayscale charges annual fees based on the price of assets under management rather than the discounted share price.

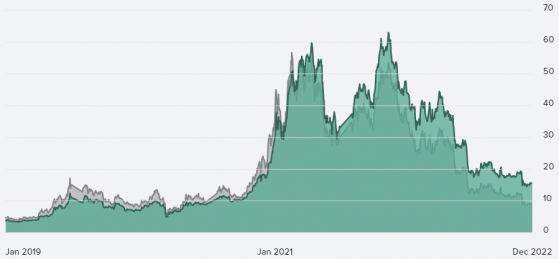

Shares in Grayscale Bitcoin Trust (GBTC), which is solely invested in bitcoin, are currently at a 43% discount to the US$10.7bn in bitcoin it has under management.

Holdings per GBTC share are currently US$15.53, while market price per share is only US$8.77.

Grayscale’s BTC holdings (light green) against GBTC’s share price (dark green) – Source: grayscale.com

One major investor into GBTC is Ark Investment Management head Cathie Wood, who recently took advantage of GBTC’s near-record discount to snap up over US$2.5mln in the trust’s shares.

Read more: Cathie Wood buys the Grayscale Bitcoin Trust dip

Grayscale is holding onto hopes that the US Securities and Exchange Commission (SEC) will give the regulatory go-ahead for spot bitcoin ETF, at which point the firm will convert its bitcoin trust into an exchange-traded product.

“In 2013, we launched Grayscale Bitcoin Trust (GBTC) to provide investors with access to bitcoin, and always with the intention of converting it to an ETF when permitted by US regulators,” a Grayscale spokesperson told Bloomberg.

“We remain 100% committed to converting GBTC to an ETF, as we strongly believe this is the best long-term product structure for GBTC and its shareholders,” added the spokesperson.

But under chair Gary Gensler, the SEC has shown little willingness to work with stakeholders on welcoming spot EFTs to the stock market.

According to Bloomberg, Fir Tree is also seeking internal files about the alleged interdependency of Digital Currency Group’s businesses, which includes Grayscale and the struggling crypto broker Genesis.

Read more: Winklevoss Twins-owned crypto exchange Gemini demands US$900mln from crypto broker Genesis

Genesis purportedly has over US$1.8bn in outstanding customer liabilities, and is facing its own legal pressure from the Winklevoss Twin-owned crypto exchange Gemini to get some of those liabilities back.

Grayscale has been asked for a comment.

Read more on Proactive Investors AU