Cryptocurrency conglomerate Digital Currency Group (DCG) has been forced to sell shares in its multibillion-dollar Grayscale investment vehicles at massive discounts in order to pay up spiralling debts.

According to filings seen by the Financial Times, DGC, which runs the world’s largest bitcoin fund Grayscale Bitcoin Trust (GBTC), is mainly capitulating on its US$5bn (£4.2bn) Ethereum fund, with US$22mln raised from selling shares as a 50% discount to the fund’s underlying holdings.

DCG will need to raise considerably more than that if it hopes to meet the US$900mln worth of obligations owed to former business partner Gemini.

Gemini, the cryptocurrency exchange owned by Cameron and Tyler Winklevoss, initially partnered with DCG’s custodian arm Genesis for the former’s Earn programme, which gave retail investors the opportunity to earn yield by lending their digital assets to borrowers.

Genesis froze Gemini customers out of their accounts in November, leading to a public fallout between the two companies and legal action threatened by the Winklevoss Twins.

Genesis has since filed for Chapter 11 bankruptcy protection, but according to a recent statement, an agreement has been made through the bankruptcy court to return assets to Gemini customers.

1/ Today, @Gemini reached an agreement in principle with Genesis Global Capital, LLC (Genesis), @DCGco, and other creditors on a plan that provides a path for Earn users to recover their assets. This agreement was announced in Bankruptcy Court today.DCG purportedly owes a further US$900mln to other creditors in addition to Gemini.— Cameron Winklevoss (@cameron) February 6, 2023

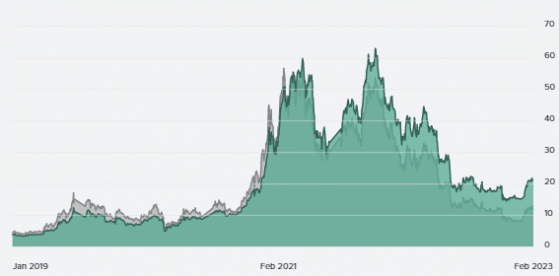

Grayscale shares weren’t always at a discount. In fact, GBTC ran at a premium to the price of bitcoin for most of 2019 and 2020.

Things began to nosedive after the crypto markets hit their peak at the end of 2021, eventually reaching a 50% discount in the past few months.

With bitcoin’s strong rally in the opening weeks of 2023, the discount has closed in somewhat, but it will take more than that for the trust's reputation to recover.

GBTC shares (dark green) tank against underlying assets (light green) – Source: grayscale.com

Shareholders are at a disadvantage due to their inability to redeem shares, meaning their only exit option is to sell them off at a discount (if buyers can even be found in the first place).

Grayscale has staunchly refused to allow for redemptions, insisting that its policy remains in converting the trust into an exchange-traded fund.

But the Securities and Exchange Commission (SEC) has denied DCG’s request for admission onto the stock market every step of the way, and under crypto sceptic Gary Gensler, that policy is unlikely to change.

For now, DCG is unlikely to allow for shareholder redemptions. With annual fees as high as 2.5% applied to over US$20bn worth of assets under management, its investment portfolio remains a lucrative cash cow.

Read more on Proactive Investors AU