Investing.com - Goldman Sachs (NYSE:GS) analysts have reiterated their buy rating for Qantas Airways Ltd (ASX:QAN), predicting a structural improvement in earnings capacity, driven by an A$1 billion cost reduction program.

The ongoing investment in customer experience is also showing promising results, improving operational performance and mitigating key downside risks.

Analysts noted, "QAN’s current market capitalisation in line and enterprise value still 5% below pre-COVID levels. As such, we believe QAN is not priced for a generic recovery, let alone prospects for improved earnings capacity."

Key catalysts that could trigger a positive market response include trading updates and the earnings release on August 24.

Despite higher fuel prices and continuous customer experience investments, the analysts' forecasts indicate a PBT 51% above pre-COVID in FY24e and 61% higher in FY25e.

QAN is trading at a 29% discount at 6.4x FY25 PE, more than 2x below the historical 5-year average discount. The analysts expect this gap to narrow as QAN delivers earnings that are sustainably above pre-COVID levels and demonstrates its ability and willingness to distribute capital to shareholders while renewing the fleet.

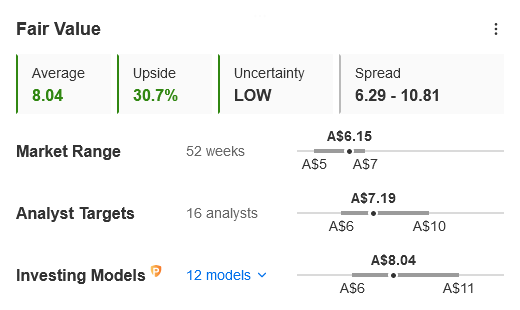

Goldman Sachs reiterated a buy rating with a 12-month price target of 8.05.