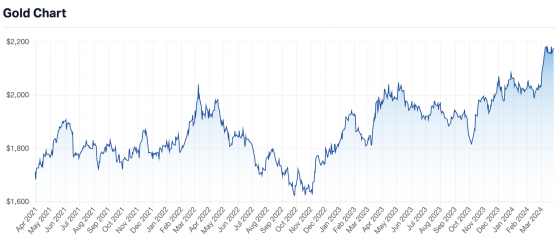

Having hit an all-time high of $2,222 this month, investors are wondering if gold will continue to be a good investment for the rest of 2023 and into the years ahead?

Gold’s unique properties and limited supply have cemented its status as a cornerstone of wealth and financial stability – perhaps never more so than at times of unease and instability.

As a safe haven asset, the gold price movement often exhibits an inverse correlation to other investments, making the commodity a great hedge against financial troubles. Yet it is also an asset that has shown steady and solid growth in value for a long time.

Source: MarketIndex.

Gold prices are subject to multiple factors, including central bank activities, the strength of the US dollar, economic uncertainty and demand in the jewellery sector. Central banks' net purchases or sales of gold can significantly impact its global price, while the value of the US dollar inversely affects gold's pricing.

Given the uncertain state of global economies, and backed up by technical analysis, it appears that the gold price may still have further to run, tempting investors to add gold exposure to their portfolios.

Gold can be easily traded on the ASX via exchange-traded funds (ETFs) such as Physical Gold (GOLD), Perth Mint Gold (PMGOLD) and Betashares (ASX:BBUS) Gold Bullion (QAU). These instruments offer investors exposure to gold price movements and can play a valuable role in diverse investment portfolios.

Investors can also add gold exposure to their portfolios by investing in ASX-listed gold producers and exploration companies, whose valuations are influenced by movements in the gold price.

Predictive Discovery (ASX:PDI)

Predictive Discovery Ltd (ASX:PDI, OTC:PDIYF) is focused on identifying and developing gold deposits within the Siguiri Basin, Guinea.

The $446 million capped company, which was recently added to the ASX300 Index, is developing the Tier-1 Bankan Gold Project in Guinea, the largest gold discovery in West Africa in a decade.

With a growing resource base of 5.38 million ounces of gold (4.14 million ounces in the indicated category and 1.24 million ounces inferred), PDI’s strategy is to sustainably bring Bankan into production whilst identifying and developing other deposits within this underexplored region.

A pre-feasibility study (PFS) for Bankan is in progress, having recently been upgraded from a scoping study. The company says the PFS is progressing well and will be published mid-April with PDI aiming to secure an exploitation permit by around mid-year.

The Bankan permits, which contain a 35-kilometre-long gold super-structure, are highly prospective for additional discoveries and PDI is ramping up its near-resource and regional exploration efforts, with multiple targets being tested by drilling.

Perseus Mining

Perseus Mining Ltd (ASX:PRU, TSX:PRU, OTC:PMNXF) operates three gold mines in Africa - Edikan in Ghana and Sissingué and Yaouré in Côte d’Ivoire. Perseus has also recently acquired Orca Gold and now owns 70% of the Meyas Sand Gold Project in Sudan.

The company, which is trading with a $2.84 billion market cap, increased annual gold production to 535,281 ounces in the 2023 financial year, at an all-in site cost (AISC) of US$959 per ounce.

Perseus has been looking for additional gold assets in Africa to grow its portfolio, and as of this week, it seems Perseus’ takeover offer for OreCorp Ltd will be accepted by OreCorp shareholders. Perseus now holds at least 42.57% of OreCorp.

If successful, this would see the Nyanzaga Gold Project in northwest Tanzania added to the company's portfolio of gold assets.

Nyanzaga is located near Barrick Gold’s Bulyanhulu mine and AngloGold Ashanti (ASX:AGG)’s Geita mine. A 2022 definitive feasibility study gave the project an after-tax net present value of $618 million at a 5% discount rate and an internal rate of return of 25%.

Northern Star Resources (ASX:NST)

The ASX’s largest gold company — and one of the world's 10 largest gold miners — is Northern Star Resources.

Northern Star owns and operates three world-class gold production centres (Kalgoorlie, Yandal and Pogo), in highly-prospective geological settings in the low sovereign risk jurisdictions of Australia and North America.

Northern Star continues to invest in building its asset base through strategic acquisitions and investing in exploration and its extensive organic growth pipeline to unlock value from the gold endowment across its highly prospective ground.

West African Resources

West African Resources is a $1.19 billion market cap mid-tier producer operating the Sanbrado Gold Operation and Kiaka Gold Project in Burkina Faso.

The company updated its mineral resources and ore reserves in February, which now stand at 12.8 million ounces and 6.1 million ounces of gold, respectively.

It is targeting +400,000 ounces of gold production per annum from 2025 from Sanbrado and Kiaka.

In 2023 the company produced 226,823 ounces of gold at a cost (AISC) of US$1,136 per ounce, generating cashflow from operations of A$209 million, while also investing US$116 million in growth at its 7.9 million ounce Kiaka Gold Project.

WAF maintains its guidance for 2024 at 190,000-210,000 ounces of gold at an AISC of less than US$1,300 per ounce.