The move to a carbon-neutral future involves a seismic shift, but a new report from KPMG indicates that global miners are ready to face the challenge head-on.

The multinational management consultant surveyed more than 430 mining and metals executives, revealing the majority of resources magnates are optimistic they can meet the demand for clean energy minerals.

2015’s Paris Agreement saw nearly 200 parties band together to combat climate change, determined to ratify efforts to curb global warming and reach net-zero emissions by 2050.

Critical minerals are at the heart of the clean energy technologies that will power this shift, meaning demand for these commodities will have to rise dramatically over the next two decades.

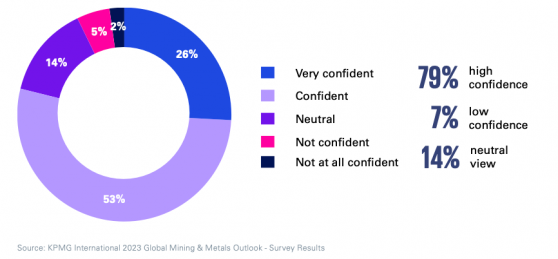

However, KPMG’s 2023 Global Mining Outlook indicates the vast majority — 79% — of executives surveyed are confident the sector can cater to future demand.

Simultaneously, the same percentage of C-suiters believe the industry can meet growing global demand without compromising its own ESG and net-zero objectives.

There are several factors at play here, but one clear idea is surfacing: global miners believe decarbonisation is not merely a cost of doing business, but a vital growth opportunity.

KPMG International's ICNN (International Council on Mining & Metals) president and CEO Rohitesh Dhawan said the sector was entering a phase “that we’ve never had before”.

“The world is now fully invested in our industry in a way it was not previously. This means that the things that got us here aren’t the things that will take us to the next phase in our relationship with society. It requires us to engage differently,” he explained.

Of course, technology remains pivotal to achieving a carbon-neutral future — and the way miners feel about the industry’s place in this cleaner, greener world.

“The specific opportunity over the next five years is to transform the carbon footprint of their operations through technology investments. That’s about embracing innovation," said KPMG global mining leader Trevor Hart.

While opportunity abounds, Hart pointed out there’s a need for resources stocks to balance expansion and ESG goals.

"The report shows the mining and metals industry as a whole is confident it can reconcile rapid output growth with sustainability goals," he noted.

“It can meet growing global demand without compromising its own ESG and net-zero objectives.”

As expansion and ESG considerations intersect, a large majority of those surveyed indicated they intend to invest in decarbonisation efforts.

Their outlook is infectious: the ratio of optimists to pessimists on whether the industry can achieve its growth and net-zero targets is nearly 10 to one, revealing strong optimism across the board.

Beyond its environmental footprint, the mining industry is not foregoing its social responsibilities.

The KPMG report shows mining companies are focused on providing their workforce with healthcare, paid leave and retirement benefits — all essential elements for a sustainable and equitable future in mining.

In the drive to net-zero emissions, clarity in communication also features high on the industry's list.

Nearly half of the executives surveyed emphasised the need for transparent communication with stakeholders about their progress towards achieving net-zero objectives.

As the mining industry grapples with the transition towards carbon-free solutions (without harming the environment), the KPMG report concludes with an optimistic yet cautionary note from Hart: "It’s encouraging the sector is confident it can deliver on growth and net zero, but we’re not saying it will be easy.”

“Our report shows metals and mining company executives understand that to succeed in reconciling ambitious growth targets with stringent carbon-reduction objectives, they will have to design their operating model to accommodate both objectives.

“Achieving net-zero carbon emissions by 2040 or 2050 may seem a long way off, but now is the time to integrate those ambitions into enterprise strategy.”

Read more on Proactive Investors AU