Global Lithium Resources Ltd (ASX:GL1) has reported a whopping 90% increase in lithium grade at its Manna Project thanks to ore sorting tech trials at the Steinert facility in Perth, WA.

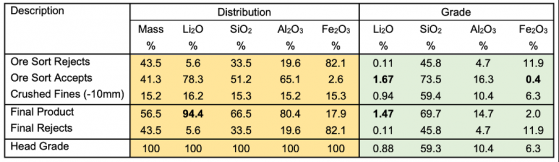

The initial trial elevated Manna’s head grade from 0.88% lithium oxide to 1.67% in a single pass and reduced its iron content to 0.4% — an impressive 93% reduction.

This accomplishment bodes well for the Manna project as Global moves into feasibility work, with a definitive feasibility study (DFS) slated for completion by year's end.

GL1 also believes there’s scope to expand the total mineable tonnes and head grade at Manna — a move that would set up the dominos for a future production scenario.

Summary of ore sorting results.

Technology “a perfect fit” for Manna lithium

Global Lithium project director Tony Chamberlain said: “The Manna Lithium Project has the distinct advantage of having great visual control between ore, which is predominantly white in colour, and surrounding waste rock which appears dark grey to black.

“Initial ore sorting results have shown the technology is a perfect fit for Manna with this impressive upgrade in lithium content.

It’s also important to note that the sample generated for this trial simulates a worst-case scenario of ore/waste contact material entering the plant, meaning all eyes will be on Global’s ‘best-case’ results.

“Additional bulk diamond core has been obtained from Manna and further samples are being prepared for larger scale trials,” the director explained.

Chamberlain went on to say that ore sorting technology would ultimately provide greater operational flexibility within Global’s mining operation, thereby increasing head grade to the mill.

“We look forward to updating the market with further results from these trials as activities continue towards completion of the Manna DFS by December 2023,” he concluded.

The ore sorter product streams, with accepts on the left and rejects on the right.

Where to next?

With the initial ore sorting trial marked off the to-do list, Global believes it’s made major strides towards unlocking Manna’s lithium bounty.

In essence, its optimised process allows larger areas with thin lithium-bearing pegmatites and waste ore (typically exhibiting a lower head grade) to be economically mined, hence boosting Manna’s minable tonnes.

By using ore sorting equipment, Global can also produce direct shipping ore concentrates at a low cost — a move that could lead to lower transport expenses and higher prices on the market.

Global will continue to put the ore sorting tech through its paces, with plans laid to produce two large samples and confirm overall lithium recoveries and impurities for the DFS flowsheet.

The lithium stock will keep the market updated on this and its DFS project as it enters the next stage of development at Manna.

Read more on Proactive Investors AU