Geopacific Resources Ltd (ASX:GPR) has raised the combined measured and indicated resource for its 100% owned Woodlark Island Gold Project in Papua New Guinea to 94% from 86% of the total mineral resource estimate (MRE).

The increase follows the completion of the company’s resource expansion drilling in the vicinity of the currently defined open pits for the year.

Drilling has improved confidence in the resource and better defined the high-grade zones within the project, including a better understanding of the area’s geology to target future exploration activities.

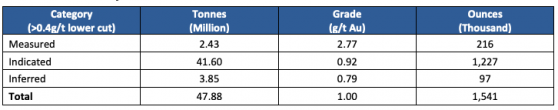

Woodlark Project total mineral resource.

The JORC-compliant MRE is hosted within the four separate mineral deposits of Kulumadau, Busai, Woodlark King and Munasi.

Near surface high-grade measured resources have been defined in Kulumadau with 0.71 metric tonnes at 4.13 g/t gold and at Busai with 1.7 metric tonnes at 2.2 g/t gold.

Map of Woodlark showing principal deposit locations.

The updated MRE was based on a gold price of US$2,400 per ounce and a cut-off of 0.4 g/t gold and was prepared by independent consultants Manna Hill Geoconsulting.

Along with the update, Geopacific has re-assessed the project’s existing ore reserve and made material changes to a number of key assumptions relating to operating and capital costs due to changing market conditions, potential changes to project design and scale and better gold prices.

This means that further work is required before an updated ore reserve estimate can be delivered for Woodlark.

Read more on Proactive Investors AU