Following some weather and technical-based impacts to the Abra Lead-Silver Mine’s ramp-up schedule, Galena Mining Ltd (ASX:G1A) has raised an additional $20 million in working capital in an oversubscribed share placement to push through to steady-state production at the Western Australian mine.

The placement, which offered 133 million shares at an issue price of $0.15, enjoyed strong support from existing shareholders and new institutional investors, with particular support from:

- Warburton Group, an existing investor with a large holding in G1A, subscribed for $3.6 million;

- Taurus, the Abra Mine’s project financing debt provider, subscribed for $1 million; and

- G1A’s directors subscribed for $400,000 worth of shares.

Targeting swift production ramp-up

“The requirement for additional working capital during ramp-up is disappointing, considering the effort and diligence that everyone involved has put into progressing the mine to this stage,” Galena Mining managing director Tony James said.

“The revised geology information affecting the ore that was hard against the Abra fault has been a short-term technical change we did not expect or anticipate.

“That ore has been replaced by lower-grade ore and we will continue our ramp-up to steady-state production as quickly as possible moving away from the upper northern margin of the orebody.

“The rain in the last week of March hurt us as we have had to slow down work until we re-stock the critical supplies required at the mine.

“The mine handled the rain well but the main access roads were hit hard causing extended delays into April.”

Updated production guidance

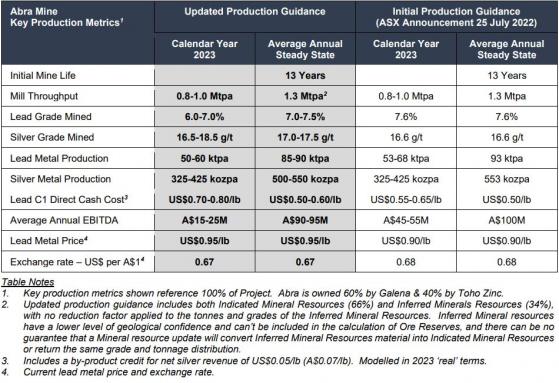

Galena expects lead production for 2023 to reduce from the previous guidance of 53-68,000 tonnes to 50-60,000 tonnes due to the aforementioned delays.

Production unit costs are also expected to increase because of lower-than-expected lead production, meaning a 12% increase in overall costs since last guidance in July 2022.

“The updated guidance for 2023 also includes some of the cost challenges that everyone in the industry is seeing,” James explained.

“Our plan is to push through this ramp-up period as quickly as possible to get into consistent steady-state production.”

A summary of the updated production guidance is detailed below:

Read more on Proactive Investors AU