Nearly two weeks after delivering a mineral resource update for its Abra Base Metals Mine in the Gascoyne region of Western Australia, Galena Mining Ltd (ASX:G1A) has fielded further high-grade lead and silver results from recently completed drilling.

Two underground drill rigs have continued working at Abra after the MRE cut-off date of May 5, completing a further 70 holes for 13,336 metres of drilling.

Highlight intercepts from the lates results include:

- 18.9 metres at 17.1% lead and 30 g/t silver;

- 38.3 metres at 12.1% lead and 15.4 g/t silver;

- 26.4 metres at 11.9% lead and 28.6 g/t silver; and

- 35.7 metres at 11.7% lead and 53.4g/t silver.

Earlier this month, the mineral exploration company released an updated resource for Abra comprising 33.4 million tonnes of ore at 7.1% lead and 17 g/t silver, calculated at a 5% lead cut-off grade.

Within that total, 300,000 tonnes of resource grading 7.3% lead and 32 g/t silver lies in the measured category, 16.2 million tonnes grading 7.3% lead and 19 g/t silver are indicated and 16.9 million tonnes grading 6.9% lead and 15 g/t silver are classified as inferred.

The resource update is built on 163 underground diamond drill holes covering 26,277 metres and geology mapping in excess of 7,300 metres of underground development, including mining depletion.

More drilling

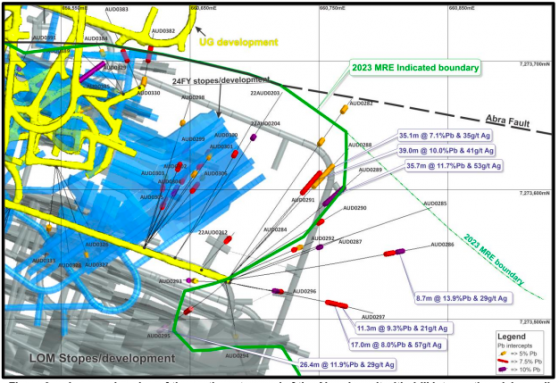

A significant portion of Abra’s mining plans has now been drilled to a 12-metre-by-12-metres spacing, extending both the Apron and Core mineralisation to the northeast of the deposit.

Encouraged by the results and with further understanding of the ore to be mined, Galena has begun planning for drilling of the Abra North and Abra Copper-Gold targets below the existing mineralisation over the next 12 months.

Big break

“These strong results complement our mine plans over the next 12 months,” Galena managing director Tony James said.

“Geologically, they show the importance of the interface between the Core and Apron zones and the potential extension of the deposit to the northeast.

“As mining progresses in these areas on multiple fronts and levels, it will generate enormous opportunity for us as we continue improving our production profile.”

Plan view of the northeastern end of the Abra deposit with drill intersections lying outside the current mining shapes and the MRE boundary.

Important project

The Abra Base Metals mine, which is 60% owned by Galena, is a globally significant lead-silver project situated between the towns of Newman and Meekatharra, some 110 kilometres from Sandfire’s DeGrussa Project.

In 2019, Galena produced a robust definitive/bankable feasibility study for the development of an underground mine and processing facility to produce a high-value, high-grade lead-silver concentrate.

A final investment decision to complete the project was made in June 2021 and construction was completed in December 2022, with the first concentrate produced in the first quarter of 2023.

Read more on Proactive Investors AU