Future Metals NL (ASX:FME, AIM:FME) has struck an exploration joint venture (JV) with fellow ASX-lister Octava Minerals Ltd (ASX:OCT), establishing a partnership that increases FME’s exposure to nickel-copper-platinum group metal (PGM) opportunities in the East Kimberley.

Under the JV agreement, Future has the right to earn up to a 70% stake in the East Kimberley Project’s Panton North and Copernicus North tenements. To do so, it’s required to spend at least A$2 million on exploration over the next four years.

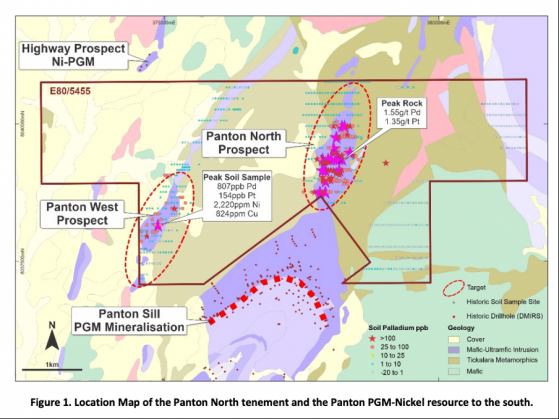

The deal more than doubles Future’s exploration position at Panton and has notable synergies with its flagship Panton nickel-copper-PGM project immediately to the south, which is reported to host 5 million gold, platinum and palladium ounces and 238,000 tonnes of nickel.

Octava will also receive up to $600,000 worth of Future Metals shares and will be free-carried through to a decision to mine.

“Significant opportunity”

Future Metals managing director Jardee Kininmonth said: “This joint venture farm-in arrangement significantly increases Future Metals’ exploration position in the East Kimberley, thereby providing further scope to explore what is highly prospective ground for nickel-copper-PGM sulphide mineralisation.

“Panton North and Copernicus North have been subject to only limited, shallow drilling despite compelling geochemical and electromagnetic anomalies.

“There is a significant opportunity to apply modern geophysical techniques, such as those being applied at Future Metals’ Panton project to identify high-quality targets for economic accumulations of nickel-copper-PGM sulphides at depth.

“The East Kimberley is a very under-explored part of Western Australia despite the Halls Creek Orogen being prospective for emplacement of nickel-copper-PGM sulphide deposits.

“Securing prospective exploration ground enables us to apply our exploration model more widely, increasing the likelihood of making further economic nickel-copper-PGM discoveries.”

What’s on the table?

Future Metals will up its Panton exposure with an exploration investment in the Panton North and Copernicus North tenements.

Panton North contains an extension of the prospective Panton keel position, with anomalous nickel, copper and PGM grades confirmed by historical drilling, soil and rock chip sampling.

The project is home to another intrusion that has showcased coincident nickel-copper-PGM anomalism in soil samples, along with magnetic and electromagnetic anomalies with no prior drill testing.

The Panton North tenure also provides contiguous land holding to Future’s 100% owned Panton PGM-nickel project, providing additional project development flexibility.

Meanwhile, the Copernicus North tenement is a highly anomalous nickel-copper prospect along strike from the historical Copernicus nickel-copper mine.

“Great outcome for both parties”

Octava managing director Bevan Wakelam said: “We are extremely pleased to have established this exploration joint venture with Future Metals, which is a great outcome for both parties.

“Octava expects to benefit from Future Metals’ expertise in nickel-copper-PGM sulphide exploration, together with its well-established infrastructure in the region, while the farm in provides Future Metals with additional highly prospective ground immediately adjacent to their significant JORC mineral resource.

“We look forward to Future Metals commencing exploration activities. This agreement allows Octava to maintain its focus firmly on its key Talga Lithium Project in the Pilbara of Western Australia.”

The fine print

Future Metals can work its way up to a 70% interest in the East Kimberley Project by spending the following cumulatively over the next four years:

- Year one: A$250,000;

- Year two: A$750,000;

- Year three: A$1.25 million; and

- Year four: A$2 million.

Future Metals also has the right to apply for a mining lease over a portion of the exploration lease as part of the development of its adjoining Panton PGM-nickel project.

The explorer will now issue 3.5 million shares to Octava (priced at 11.4 cents apiece, valuing the basket at A$400,000), and these will be escrowed for 12 months.

A further A$200,000 will be paid out one year from now in either cash or shares (at Future’s discretion).

Of course, the exploration JV rests on a number of conditions, including:

- completion of financial, legal and technical due diligence;

- shareholder and regulatory approvals

- the upfront consideration; and

- an executed escrow agreement.

Read more on Proactive Investors AU