“Never in my career have I seen such a complete failure of corporate controls and such a complete absence of trustworthy financial information as occurred here.”

Those words from FTX’s new restructuring executive John J. Ray III will go down in crypto infamy.

Ray should know, given he advised on the restructuring of Enron, of all companies.

“From compromised systems integrity and faulty regulatory oversight abroad, to the concentration of control in the hands of a very small group of inexperienced, unsophisticated and potentially compromised individuals, this situation is unprecedented,” read Ray’s Chapter 11 statements.

The filing painted a picture of structural incompetence.

According to Ray, none of SBF’s venture capital fund Alameda Research’s financial statements has been audited, thus he does “not have confidence” in them.

FTX apparently did not have an accurate list of its own bank accounts, or even an accurate record of its employees.

Furthermore, “an unsecured group email account” was used to manage the security keys for its digital assets.

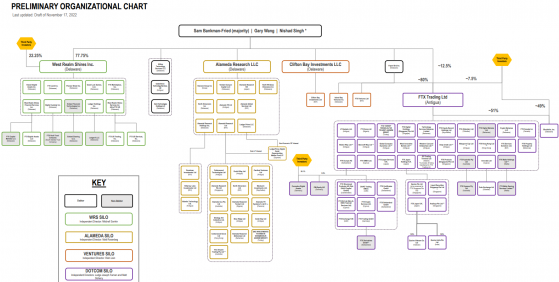

Ray also attempted to make heads and tails of the corporate structure of FTX’s once-mighty crypto empire by dividing them into four silos.

SBF’s maze of a corporate structure – Source: US Bankruptcy Court

In similar comments made by Binance head Changpeng ‘CZ’ Zhao, who was one of FTX’s earliest investors, Ray acknowledged that “many of the employees of the FTX Group, including some of its senior executives, were not aware of the shortfalls or potential commingling of digital assets.

“Indeed, I believe some of the people most hurt by these events are current and former employees and executives, whose personal investments and reputations have suffered”.

FTX’s 'hacker' comes forward

FTX’s new ownership has hired a team of forensic blockchain experts to track down potentially missing funds, as well as cybersecurity professionals to identify the parties responsible for the “unauthorised transactions on and after the petition date”.

The latter comment refers to a US$600mln transfer out of the exchange on November 12 in what was suspected to be a hack.

However, the Bahamian government has just done the cybersecurity professionals’ work for them.

Today, the Securities Commission of The Bahamas officially disclosed that it ordered Sam Bankman-Fried to “transfer of all digital assets of FTX Digital Markets Ltd. (FDM) to a digital wallet controlled by the Commission, for safekeeping”.

According to the commission’s statement, it “will engage with other regulators and authorities, in multiple jurisdictions, to address matters affecting the creditors, clients and stakeholders of FDM globally to obtain the best possible outcome.

In another perhaps unsurprising revelation, Ray said: “I understand that corporate funds of the FTX Group were used to purchase homes and other personal items for employees and advisors.”

All in all, a calamitous mess of mindboggling scale.

Read more on Proactive Investors AU