Frontier Digital Ventures Ltd (ASX:FDV) has raised A$13 million to partially fund final payments for the acquisition of FDV LATAM businesses, InfoCasas and Encuentra24. The balance of the cash consideration payments for the acquisitions will be funded from existing cash reserves.

The institutional placement was well supported and will be backed up by a share purchase plan (SPP) to raise a further $2 million, giving all shareholders the opportunity to participate in the raise.

FDV acquired the remaining 49% interest in InfoCasas in December 2021 and moved from 26% to 100% ownership in Encuentra24.

Each transaction required contingent consideration payments, which FDV will now finalise.

InfoCasas and Encuentra24 are two of the largest businesses in FDV’s portfolio and have demonstrated strong operational performance since the company’s move to 100% ownership. Note, 100% ownership of the companies consolidated FDV’s position with full ownership of FDV LATAM.

“We are delighted by the significant progress made by InfoCasas and Encuentra24 since we reached 100% ownership. FDV LATAM now represents the largest region in our Group by revenue, with an attractive long-term growth and monetisation profile,” FDV dounder and CEO Shaun Di Gregorio said.

“We are grateful for the ongoing support from both existing and new institutional investors as part of the institutional placement. We are also pleased to provide our retail shareholders with an opportunity to participate in the capital raising via the share purchase plan.”

About the payments

In October 2022, key selling shareholders of InfoCasas and Encuentra24 entered into subscription agreements to exchange a minimum proportion of their expected future contingent consideration payments for equity in the FDV LATAM holding company.

This exchange is subject to satisfaction of certain conditions and discussions are ongoing as to whether key shareholders will be issued equity by the FDV LATAM holding company or FDV.

Once conditions are met key shareholders may elect to exchange the minimum proportion of the anticipated final cash consideration payment for equity (either in FDV LATAM or FDV), the final cash component of the contingent consideration payment for the acquisitions of InfoCasas and Encuentra24, is approximately A$26.1 million.

Better performance

Since acquiring 100% ownership in InfoCasas and Encuentra24, the performance of both companies has impressed.

InfoCasas is the leading property portal in Uruguay, Paraguay and Bolivia, while Encuentra24 is the leading classifieds marketplace in five key Latin American markets, with strong presence across key property and auto verticals.

Both companies represent the largest wholly-owned operating companies in FDV’s portfolio by FY22 revenue (100% basis).

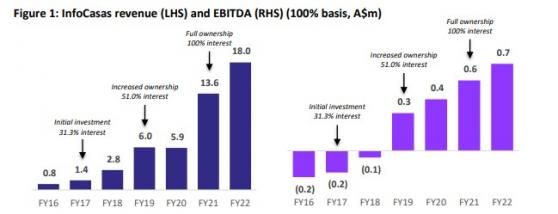

InfoCasas has achieved a revenue compound annual growth rate (CAGR) of 67.8% from FY17 to FY22, primarily related to its core classifieds business and more recently successful transactions strategy. It has exceeded expectations since FDV moved to 100% ownership, with revenue and EBITDA increasing 32.3% and 23.6% respectively in FY22 relative to FY21 (100% basis).

Meanwhile, there has been significant improvement in Encuentra24’s EBITDA profile since FDV moved to 100% ownership, with EBITDA improving ~7x between FY21 and FY22, representing an expansion in EBITDA margin from +1% to +8% (100% basis).

Revenue grew to A$9.8 million in FY22, representing a 17% increase on FY21 (100% basis). The rapid transition of Encuentra24’s financial profile provides a sustainable platform for long-term growth.

Team growth

The acquisition of InfoCasas and Encuentra24 enhanced FDV’s scale and strategic footprint in the Latin American region and enabled the company to introduce a local leadership team.

The team is led by Ricardo Frechou and Guillermo Tavidian as CEO and CTO of FDV LATAM, from their previous roles as CEO and CTO of InfoCasas, respectively.

The FDV LATAM leadership team aims to unlock the full value of the region, including the sharing of InfoCasas’ proprietary technology and IP, development of new products, optimisation of leads and traffic, and an employee restructure to achieve leaner, flatter and more productive companies.

The employee, marketing and technology efficiency initiatives undertaken are expected to generate annual savings of A$3 million in FY23. FDV LATAM is now well positioned to achieve its medium-term revenue ambition of US$100 million and potential future listing of FDV LATAM on the NASDAQ.

Trading update

Portfolio EBITDA on a FDV percentage share basis in Australian dollars increased in January and February 2023 relative to January and February 2022.

Over this period:

- FDV LATAM delivered positive and improved EBITDA;

- FDV Asia delivered positive EBITDA – Zameen’s revenue was down but it remained EBITDA positive; and

- FDV MENA improved EBITDA and traded around breakeven.

Read more on Proactive Investors AU