Flynn Gold Ltd (ASX:FG1) has intersected more high-grade gold, including some bonanza grades, at Trafalgar Prospect within the 100%-owned Golden Ridge Project in northeast Tasmania, pointing to it being a significant large-scale gold resource.

Assays returned from three drill holes, including for the prioritised TFDD015, included a high-grade hit of 0.4 metres at 137.8 g/t gold from 353.9 metres within a 1.1-metre interval at 51.3 g/t from 353.2 metres.

Other notable intersections include:

- 2.45 metres at 5.1 g/t gold from 204.55 metres, including 0.55 metres at 20.22 g/t from 205.2 metres;

- 1.6 metres at 5.86 g/t from 191.7 metres, including 0.8 metres at 13.95 g/t from 191.7 metres; and

- 2.4 metres at 2.83 g/t from 167 metres, including 0.45 metres at 11.35 g/t from 168.95 metres.

This high-grade TFDD015 interval has the potential to continue both at depth and along strike in both directions.

Investors have reacted positively to the news, with Flynn Gold shares up 10.17% at A$0.065 in late morning trading.

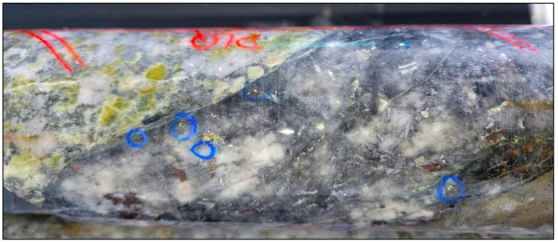

TFDD015 drill core from 354-metre depth showing mineralised pyrite-galena-sphalerite-pyrrhotite quartz sulphide vein with visible gold (circled in blue).

More potential

These, and the final results for TFDD0011 and TFDD012, have enhanced the scale of the gold system at Trafalgar, where drilling previously returned intersections grading more than 100 g/t gold such as 0.4 metres at 150 g/t from 202 metres; 0.5 metres at 143 g/t from 57.5 metres; and 0.7 metres at 152.5 g/t from 120.3 metres.

The company’s drilling program at the prospect has advanced with a total of 14 drill holes completed in two phases since May 2022, with the latest concluded in August this year.

At least four main vein zones, T1, T2, T3 and T4, have been interpreted with gold mineralisation intersected beyond 400 metres in strike length, from surface to a depth of 420 metres.

All are open along strike and at depth.

Other results

Meanwhile, final assays for holes TFDD011 and TFDD012 have also been received, which confirmed broad zones of low-to-moderate grade gold mineralisation.

At TFDD011, low-to-moderate grade gold mineralisation included intersections of 15.5 metres at 0.73 g/t gold from 255.5 metres and 48.4 metres at 0.34 g/t from 185.6 metres.

Final results for TFDD012 included high-grade intercepts associated with zones of discrete mineralised veins such as 0.7 metres at 14.98 g/t gold from 107.6 metres as well as broad zones of low-to-moderate grade gold mineralisation, including 62 metres at 0.63 g/t from 222.0 metres.

The results suggest that TFDD012 is an extension of similar veining intersected in hole TFDD0084, about 50 metres to the east.

Confidence-boosting outcome

Flynn Gold managing director and chief executive officer Neil Marston said: “The latest results from the recently completed drilling at the Trafalgar Prospect at Golden Ridge in northeast Tasmania have again delivered exceptional gold results from multiple high-grade intersections that further support the company’s target model for a significant IRGS-type gold deposit.

“Drill hole 15 was designed to test for high-grade gold mineralisation at depth beneath the historical Trafalgar main shaft and approximately 75 metres below a historical drill hole intersection which included 0.4 metres at 150 g/t gold.

“To achieve a similar high-grade result in this latest drill hole increases our confidence in the extent and orientation of these high-grade shoots, which are occurring close to the granodiorite-hornfels contact.

“Assay results for 420 metres of diamond drilling are still pending, with an announcement of these final results expected in November.”

Read more on Proactive Investors AU