Flynn Gold Ltd (ASX:FG1) has seen a flurry of activity at its Golden Ridge and Portland projects in northeast Tasmania and the results are in.

The program of diamond and reverse circulation (RC) drilling at the two projects has yielded promising results.

Anomalous gold results were returned from all the areas targeted during RC drilling and serve to confirm what the company thinks is an extensive gold mineralisation system at the Golden Ridge Project.

Highlights

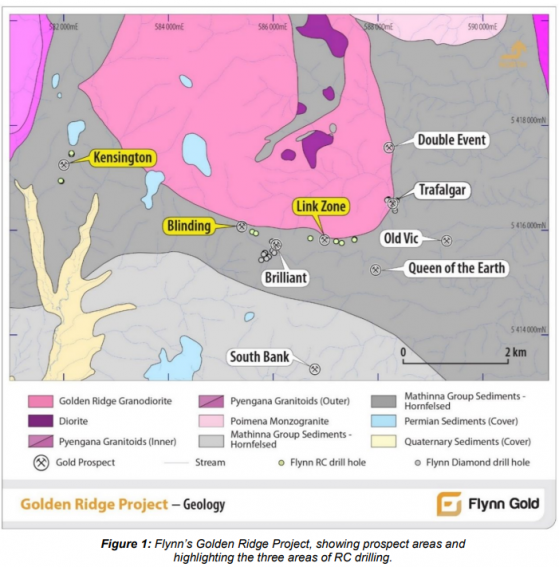

Twelve wide-spaced reconnaissance scout RC holes across three prospects - Kensington, Blinding and Link Zone - spread over 6 kilometres of strike length, returned anomalous gold intercepts including:

- 1-metre at 3.22 g/t gold from 30 metres and 2 metres at 2.83 g/t from 73 metres, including 1-metre at 4.91 g/t from 73 metres;

- 33 metres at 0.50 g/t from 40 metres, including 2 metres at 2.24 g/t from 40 metres, 1-metre at 2.26 g/t from 54 metres and 3 metres at 1.98 g/t from 61 metres;

- 2 metres at 2.82 g/t from 20 metres, including 1-metre at 5.28 g/t from 20 metres;

- 3 metres at 2.01 g/t from 1-metre; and

- 52 metres at 0.19 g/t from 26 metres, including 13 metres at 0.29 g/t from 45 metres.

The scout RC drilling was the first drilling outside the Brilliant and Trafalgar prospects at the Golden Ridge Project and represents an important step in testing the 8-kilometre-strike potential of the gold mineralisation system.

Brilliant prospect

Final assays have been received from the Brilliant Prospect Phase 1 diamond drilling, extending mineralisation that is open along strike by up to 200 metres.

The results of a review have given the company confidence in the potential for a high-grade vein system at Brilliant, with previously reported high-grade intersections from the drill program including:

- 0.5 metres at 16.05 g/t gold from 99.5 metres;

- 3 metres at 7.42 g/t from 146 metres, 0.5 metres at 19.76 g/t from 157 metres and 0.5 metres at 52.7 g/t from 195 metres; and

- 1.6 metres at 11.96 g/t from 30.4 metres.

Drilling continues at the Trafalgar prospect, with one hole complete and another on the way.

CEO Neil Marston said: “We are pleased to have intersected gold mineralisation at multiple prospects along the Golden Ridge trend confirming the prospectivity of the 8-kilometre-long granodiorite-metasediment contact zone and validating the company’s strategy to scale up its exploration efforts at Golden Ridge in 2023.

“This is the first exploration drill program ever undertaken outside of the Brilliant and Trafalgar prospects.”

“Drilling at the Link Zone prospect has intersected significant gold mineralisation in three of the five holes drilled. This is an excellent result as it confirms that there is gold mineralisation between the Trafalgar and Brilliant Prospects.

“The Kensington prospect is located five kilometres west of the Link Zone. Drilling at Kensington has also hit shallow gold mineralisation in multiple holes with one intersection exceeding 5 g/t gold, which is an impressive start to evaluating this prospect.

"Broad zones of low-grade gold intersected at Blinding prospect also provide an exciting target to follow up.”

Read more on Proactive Investors AU