Flynn Gold Ltd (ASX:FG1) has confirmed the significant potential for gold and the critical minerals cobalt, tungsten and copper at its 100%-owned Firetower Project in Tasmania in ongoing review and targeting work.

The work, incorporating desktop studies and re-logging and re-sampling of historical diamond drill core, has confirmed coherent zones of high-grade polymetallic gold, cobalt, tungsten and copper mineralisation at the project.

This includes the resampled 9 metres grading 2.56g/t gold, 0.25% cobalt, 0.32% tungsten and 0.1% copper from 99 metres deep, including 3 metres at 8.59 g/t gold, 0.29% cobalt, 0.83% tungsten and 0.21% copper from 105 metres.

Historic assays include 14 metres grading 2.91g/t gold, 0.14% cobalt, 0.24% tungsten and 0.25% copper from 33 metres; and 11 metres at 4 g/t gold, 0.05% cobalt, 0.24% tungsten and 0.25% copper from 55 metres.

The gold-dominant mineralisation also has potential high-value critical minerals byproducts, including cobalt, tungsten and copper, and Flynn notes that the cobalt grades are on par with the highest-grade significant cobalt deposits in Australia.

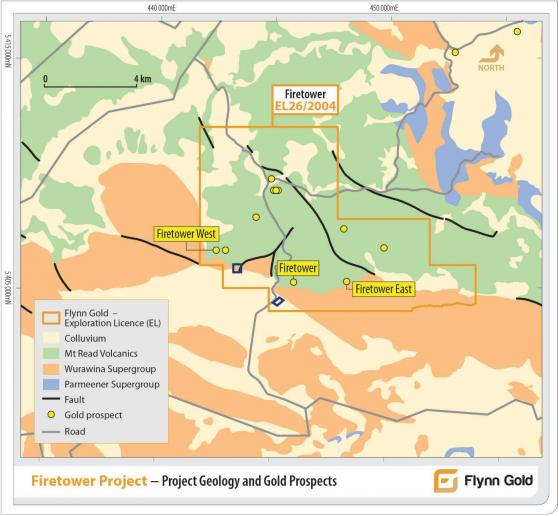

The polymetallic gold cobalt tungsten and copper mineralisation at Firetower is currently defined by historic drilling over a strike length of 200m and remains open along a highly prospective six kilometre long trend between the Firetower West and Firetower East prospects.

The mineralisation, which partly outcrops, is tested to depths of at least 100 mertre and remains open down-dip.

The six kilometres prospective strike length at the project has still only been lightly drilled, with the company due to commence a diamond drilling program in the current quarter.

“An exciting polymetallic opportunity”

Flynn Gold managing director and CEO Neil Marston said: “Since the Firetower Project was acquired from Greatland Gold PLC (AIM:GGP, OTC:GRLGF) in June 2023, the company has advanced its technical review prior to commencing field exploration activity, targeting both the gold and critical minerals potential.

“Results from recent re-assaying of historical drill core demonstrate a strong correlation between cobalt, tungsten and gold mineralisation within the deposit.

“Earlier exploration was focused on gold, however, it is now clear that this project represents an exciting polymetallic opportunity.

“Cobalt is a critical mineral with increasing demand as a key manufacturing component in the global shift toward clean technologies. With approximately 70% of global cobalt production coming from the Democratic Republic of Congo, the world will need alternative sources of this battery metal, particularly from Tier 1 jurisdictions with strong ESG credentials such as Australia.

“Tungsten is considered one of the most critical minerals due to its importance across a wide range of applications in various fields and its inability to be substituted in many of these applications due to its high melting point and hardness.

Drill testing soon

The company’s review of the Firetower Project has generated depth extension targets that it intends to commence drill testing this quarter.

This drilling comes at an opportune time, following the federal government’s recently announced Critical Minerals Strategy 2023–2030, which sets out the government’s vision to grow Australia’s critical minerals sector.

Read more on Proactive Investors AU