The ASX is higher today.

The S&P/ASX200 gained 28.30 points or 0.41% to 7,015.90, despite crossing below its 50-day moving average. The index has lost 0.88% for the last five days but is virtually unchanged over the last year to date.

Top-performing stocks in this index are Collins Food Ltd and Healius Ltd, up 9.21% and 6.02% respectively.

The S&P/ASX Small Ordinaries (XSO) is up 0.99% to 2,697.70.

Looking at the sectors, the best performing was Real Estate which gained 1.52%. On the flipside, Energy took a 0.91% tumble.

Retail weakness supports RBA hold

The recent downturn in retail sales strengthens the argument for the Reserve Bank of Australia to hold interest rates steady, suggest ANZ economists Madeline Dunk and Adelaide Timbrell.

October saw a surprising 0.2% decline in retail sales and the year-on-year growth of 1.2% marks the weakest performance since August 2021.

"The clear weakness in the retail sector highlights the ongoing squeeze on household budgets and supports the case for the RBA to keep the cash rate on hold at its December meeting," they say in a research note.

"While retail sales should receive a sugar hit from Black Friday/Cyber Monday sales in November, we expect the underlying trend in the series to remain weak. As we move into 2024, the rise in real household incomes should support retail sales."

CreditorWatch’s chief economist Anneke Thompson said of today’s release of the ABS Retail Trade figures.

“Retail sales fell an overall 0.2% over the month of October after recording rises in spending in both preceding months.

"For discretionary goods categories, this is to be expected, as many consumers will have chosen to hold off on spending for Black Friday sales, which are currently in progress.

"We expect that all categories of goods spending will see a good lift in spending in November due to these sales, following patterns that have emerged in recent years.

“The area of spending that is not impacted by Black Friday, cafes, restaurants and takeaway food services, recorded a second straight fall in spending, after bucking the trend in other discretionary categories for many months. Spending in this category fell by 0.4% and is now back to July 2023 levels. This indicates that consumers have finally started to pull back on dining out, in the face of cost-of-living pressures and rising interest rates.

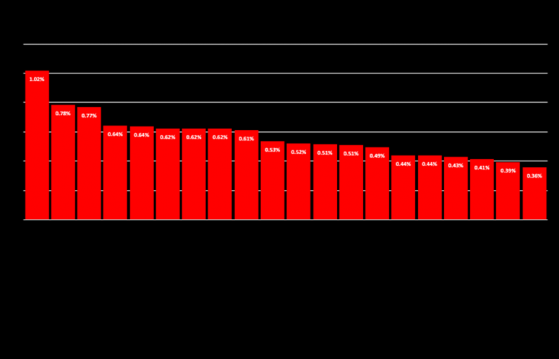

“What is concerning is that this sector already well and truly tops the rankings for external administrations by Industry. In the 12 months to December 2023, one in 100 food and beverage services businesses went into external administration.

"There are now rising headwinds in this sector, as demand falls, the ATO calls in large GST and other tax debts, and labour, rent and energy costs all continue to rise. The food and beverage sector is also the second highest-ranked industry for payment arrears (behind construction), with 9.3% of total invoices more than 60 days in arrears.”

Five at five

Volt Resources nears key deal to boost Bunyu Graphite Project amid global supply concerns

In a strategic move to capitalise on the global graphite market dynamics, Volt Resources Ltd (ASX:VRC, OTC:VLTRF) has made strong progress with financing negotiations for its wholly-owned Bunyu Graphite Project in Tanzania.

Read more

Piedmont Lithium (ASX:NASDAQ:PLL, OTC:PLLTL) partner Atlantic Lithium fields longest 106-metre pegmatite interval at Ewoyaa

The partner of Piedmont Lithium (ASX:PLL, OTC:PLLTL) in the Ewoyaa Lithium Project in Ghana, Atlantic Lithium Ltd (AIM:ALL, OTCQX:ALLIF, ASX:A11), has uncovered multiple broad intervals of visible spodumene outside of the current mineral resource during reverse circulation drilling at the flagship West African project.

Read more

Accelerate Resources confirms lithium mineralisation over 1.8 kilometres from sampling at Prinsep; shares up

Accelerate Resources Ltd (ASX:AX8) is trading higher after confirming lithium mineralisation from its detailed mapping and follow-up sampling programs at its Prinsep Lithium Project in West Pilbara.

Read more

Ora Banda Mining accelerates gold production and increases efficiency at Riverina; eyes 100,000 ounces by FY25

Ora Banda Mining Ltd (ASX:OBM) has made progress in operations at the Davyhurst project in Western Australia, particularly at the Riverina site, as part of its ambitious ‘DRIVE to 100 Project’, which is targeting production of more than 100,000 ounces of gold by the 2025 financial year

Read more

Cyclone Metals achieves “class-leading” iron concentrate of 68.7% from Project Iron Bear metallurgical test work

Cyclone Metals Ltd (ASX:CLE) has produced what it describes as a “class-leading” iron ore product with metallurgical test work on ore from the flagship Block 103/Iron Bear Magnetite Project, achieving a blast furnace concentrate of 68.7% iron with low impurities and silica content below 3.5%.

Read more

On your six

Drilling set to resume at Snowy Hydro 2.0 - Australia’s largest renewable energy project under construction

Snowy Hydro 2.0, the largest renewable energy project under construction in Australia, is back in the limelight as the NSW government prepares to issue final environmental approvals to resume drilling.

Read more

The one to watch

Aurumin sharpens focus on Sandstone with new tenements

Aurumin Ltd (ASX:AUN) MD Brad Valiukas tells Proactive the company has expanded its footprint adjacent to the 881,000-ounce Sandstone Gold Project through the grant of three new tenements at which the company hopes to source further gold mineralisation.

Watch

Read more on Proactive Investors AU