Interest rates are once again 0.25% higher than the previous month which will put more strain on individual and family budgets, however, the market has reacted kindly to a less hawkish outlook from the Reserve Bank of Australia (RBA).

The S&P/ASX200 gained 39.10 points or 0.53% to 7,367.70 and crossed above its 20-day moving average. Over the last five days, the index has gained 1.51% and is currently 3.37% off of its 52-week high.

Top-performing stocks in this index are Invocare Ltd and Sayona Mining Ltd (ASX:SYA) up 34.30% and 5.32% respectively.

The inescapable news of the day is the RBA decision – a record 10th straight raise to 3.6% with rates now returning to historical averages.

RBA hikes cash rate … again

Several economists and analysts have chimed in with commentary, here’s what they had to say:

CreditorWatch chief economist Anneke Thompson

Despite clear signs that the brakes are being slammed on the Australian economy, the RBA once again chose to increase the cash rate target. This latest increase will take many borrowers – both personal and business – well past their lenders’ serviceability test and will be a serious drag on both consumer and business sentiment.

In February we learned that while the Australian economy continued to grow in the December quarter, the growth rate slowed substantially.

Australian Gross Domestic Product (GDP) grew by 0.5% over the December quarter, down from 0.7% in September quarter and 0.9% in the June quarter.

Importantly, for both the inflation and cash rate outlook, growth in household spending rose by a moderate 0.3%.

This will give the RBA comfort – among other important indicators like monthly retail trade and labour force – that its efforts to reduce inflation are working. Unfortunately, the flip side to this success is continued pain for the Australian consumer and, ultimately, businesses.

CreditorWatch’s Business Risk Index continues to point to businesses acting in an increasingly cautious manner.

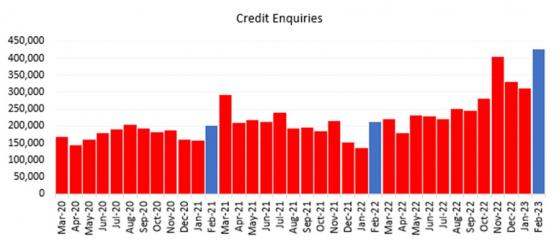

Data from February 2023 shows that credit enquiries in February 2023 were more than double those in February 2022. This is despite average trade receivables per data supplier decreasing by 10% year-on-year in February 2023.

Businesses are clearly more concerned about the financial stability of the businesses they are trading with, given the economic conditions and large decline in consumer sentiment.

Source: CreditorWatch trade receivables data (accounting software integration).

Overall, the picture for Australian businesses is looking increasingly more complicated as we move through 2023.

While the Australian economy is certainly one of the brighter spots when we think about the global economy, there is no doubt that businesses will find trading conditions far more challenging this year than last.

On the bright side, it does appear that inflation has peaked. This gives us confidence that pricing data coming through this year should, based on sentiment levels, show continued moderation in growth levels of inflation.

City Index senior market analyst Matt Simpson

An initial glance at RBA's statement suggests they are nearing the end of the tightening cycle, and perhaps one step closer to publicly discussing a pause.

By removing "The board expects that further increases in interest rates will be needed over the months ahead" in exchange for "The board expects that further tightening of monetary policy will be needed to ensure that inflation returns to target", it means they’re no longer certain that two or more hikes will be coming. And that means there may be one final hike to come, to take rates to 3.85%.

Of course, a final 25bp hike is far from certain at this point but the main takeaway for me is that the RBA has removed a key hawkish sentence from the February statement. And that is another step closer to the end of their tightening cycle.

Tiger Brokers Australia chief investment officer Brett Reynolds

The RBA has raised interest rates by 25 basis points. The story remains all about inflation. It is still far above the RBA’s target (2-3%) and rates will continue to rise while this is the case. Australian interest rates are headed over 4%, with a strong possibility they will be beyond 4.5% in the second half of the year.

The reality is Australian interest rates are returning to historical averages. We’ll likely never again see rates at the emergency levels they were at during the pandemic.

Mortgage holders will have to grin and bear the increase in rates as they return to normal levels. We know this will be tough for many people but the reality is the RBA is attempting to slow demand in the economy to curb the high inflation.

The decision by America’s Federal Reserve on its interest rates will be important to watch. US rates are now at 4.75%, they are likely to hit at least 5.5% by mid-year. This will impact the global economy and Australia’s share market. It is little consolation to many, but Australian rates do remain low against comparable nations.

Given the commentary provided by the RBA following the last meeting, I expect rates to increase again in April for the 11th straight meeting.

For the Australian economy and share market, we remain in a strong position due to high commodity prices. The market is predicting further interest rate increases and is pricing this in accordingly. Australia remains on track to avoid a recession, but it is a narrow track.

Two things to watch for the week ahead

eToro market analyst Josh Gilbert shares his two things to watch in Australia in the coming days.

1. Airlines come soaring back

The pandemic crippled much of the economy but it couldn’t have been any worse for airliners. The airline industry lost US$187 billion in the past three years, with borders closed and travel demand dented. But, fast-forward to 2023, airliners are now outperforming with soaring profits and the recovery in demand is set to continue.

Global airlines are expected to post their first profits since the 2020 pandemic this year, with Qantas expecting to see net income in excess of A$1.5 billion. Airliners are in a unique situation where they have pricing power.

Capacity has taken a downturn after being stripped during the pandemic, so given the limited available seats on aircraft and the strong appetite for travel, airliners are ramping up fares.

Holiday travel and accommodation prices soared 17.8% in the January inflation reading.

Although prices are high, 2023 won’t be plain sailing, with headwinds such as labour costs, squeezed household budgets and recession risks.

It seems for now, though, that consumers aren’t willing to give up travel after the pandemic, with many viewing travel as an essential. This will benefit names such as Qantas and Flight Centre (ASX:FLT), and investors are already seeing the rewards this year, with shares up 8% and 29%, respectively.

2. Markets to take a breather in March

Equities have seen one of the strongest starts to the year in history, with the ASX having the best January for more than 20 years, before pulling back in February.

Overseas, the S&P500 has had its second strongest start to the year in 30 years, and the Nasdaq seeing its strongest run since 2001.

Depressed asset classes from 2022 have led the performance with growth and tech shares surging, outside of equities, crypto has been the best-performing asset class this year.

However, the recent rally might be running out of legs. One of the main drivers of this rally has been the fall in bond yields, given the worry over recession risks, but yields have started to rise once again, with the 10-year yield in the US rebounding from 3.4% to 3.9% as recession risks dwindle.

The Fed doesn’t look set to be cutting rates soon and the 10-year yield may not be falling quickly either. Ultimately, the inflation fight isn’t over, and although we are long-term optimistic, investors should take caution in the size and speed of the rebound this year.

Five at five

Queensland Pacific Metals has TECH Project awarded Significant Investment Project status

Queensland Pacific Metals Ltd (ASX:QPM) has received strong validation of its strategy from the Queensland Government which has designated Significant Investment Project status for the company’s Tech Project at Lansdown in the state’s north.

Read more

Immuron CEO highlights strong sales growth in business update presentation

Immuron Ltd (NASDAQ:IMRN, ASX:IMC) CEO Steven Lydeamore highlighted the strong growth in sales of oral immunotherapeutic products in the company's February 2023 business update presentation for investors.

Read more

Great Boulder Resources lands “stunning” high-grade gold in RC campaign; best assays yet at Side Well’s Mulga Bill

Great Boulder Resources Ltd (ASX:GBR) has had results described as "stunning" from reverse circulation (RC) drilling at Mulga Bill prospect, part of the Side Well Gold Project near Meekatharra in Western Australia, fielding two intersections of coarse visible gold which returned the best assays to date.

Read more

Emyria collaborates with psychiatrist-led clinical service in MDMA-assisted therapy for PTSD

Emyria Ltd (ASX:EMD) will collaborate with The Pax Centre (PAX) to develop a scalable care program for the safe provision of MDMA-assisted therapy for patients with treatment-resistant PTSD.

Read more

Kazia Therapeutics forms clinical collaboration for Australian Phase 2 study of paxalisib, targeting childhood cancers

Kazia Therapeutics Ltd (ASX:KZA, NASDAQ:KZIA) has formed a partnership with the Australian and New Zealand Children’s Haematology/Oncology Group (ANZCHOG) for a Phase 2 clinical study examining paxalisib in children with advanced solid tumours, including brain tumours.

Read more

On your six

A nickel for your thoughts: Matt Gauci

“There's an enormous demand in commodities for anything related to the clean energy revolution and in particular the electric vehicle market and the energy storage market,” says NickelX Ltd (ASX:NKL) CEO Matt Gauci.

Read more

The one to watch

Australian Vanadium talks highlights from processing research project

Australian Vanadium Ltd (ASX:AVL) managing director Vincent Algar speaks with Proactive soon after the company successfully completed its industry-leading critical mineral research aimed at improving vanadium processing efficiency.

Watch

Read more on Proactive Investors AU