The ASX is higher today, with the ASX 200 heading for its best finish in nine days led by the energy sector.

Energy finished 3.99% higher, with Materials also having an impact with a 2.33% gain. Health Care was the worst performer, losing 0.83%.

All eyes this week have been on consumer spending and the inflation report due tomorrow.

Spending is slower but is still moving forward, with the Australian Bureau of Statistics showing a modest 0.2% increase for the three months leading into the new year.

"Aussies are spending because they have jobs. Some spending is being cut (household goods, 'other' retailing), but higher wages and job security mean that consumers don't need to engage in a total clearance of non-essential or discretionary spending," Commonwealth Bank economist Craig James said.

"These factors together with the latest news on the global banking jitters will determine what the Reserve Bank does on interest rates in a week's time.”

The Reserve Bank of Australia (RBA) signalled a pause, however as the Fed recently raised rates another hike isn’t out of the question.

3 things to watch for this week

eToro market analyst Josh Gilbert shares his three things to watch in Australia in the coming days.

1. Rate hike expectations dialled down, investors take on more risk

Last week saw the seventh straight decline for the ASX200, its worst run for over a decade. With the US banking crisis tightening financial conditions, markets anticipate that the Federal Reserve could be done with its jumbo rate hike cycle.

This has significantly impacted the local market as investors take on more risk with tech stocks and rotate away from defensive assets that dominate the ASX200. For context, the technology sector makes up just 2.7% of the ASX200, whilst financials, one of the worst-performing sectors this year, makes up a massive 28%.

The likely peaking of interest rates and lower inflation outlook supports risk assets and has also helped boost crypto, with bitcoin soaring 70% this year.

Ultimately, this could mean more weakness for the local market as the rotation continues, but the positive is that investors won’t be willing to completely give up their safe haven stocks just yet, with the inflation fight globally still not over.

2. Australian monthly CPI: Was December the peak?

This week (March 29), Aussie investors will be hoping to see another decline in inflation. After January’s reading of 7.4%, the RBA has stated that inflation has peaked, raising investor hopes that a pause in its tightening cycle is in sight.

Expectations are for February’s monthly inflation reading to come in at 7.1%, falling significantly from December’s peak of 8.4%.

The full effect of the RBA’s 10 consecutive hikes are yet to be felt and the board continues to have a tricky task in walking the fine line between bringing down inflation and not tipping the Australian economy into recession. However, looking overseas, we can see that it’s not plain sailing to get inflation under control.

UK inflation is stubbornly high, with all readings since September coming in above 10%. The recent overseas banking crisis has also thrown a spanner in the mix for the RBA but board members quickly reassured consumers this week that banks were unquestionably strong.

3. Retail sales for February: Are high inflation and rising rates squeezing Aussies?

Retail spending bounced back in January after plunging in December, but investors will be looking to see if that resilience can continue.

After months of continued spending, high inflation and rising rates are squeezing Australian consumers. The RBA will be looking towards retail sales and hoping for another slowdown in spending, particularly as their tone has turned dovish in recent weeks.

Household spending accounts for around 60% of GDP, and strong sales will be key to Australia’s growth this year, but the follow-through from the RBA’s consecutive rate hikes may dampen consumer spending.

Ultimately, consumer sales will be patchy throughout 2023, and consumers will more than welcome an end to the RBA’s tightening cycle.

What do the retail figures mean?

CreditorWatch’s chief economist Anneke Thompson had this to say regarding today’s release of the ABS Retail Trade figures.

February Retail Trade data indicates that Australian consumers are continuing to reduce their spending on discretionary goods.

Spending on Household Goods was flat over the month of February while spending on ‘Other Retail’ declined by 0.4%. However, spending in Department Stores rose by 1% over the month, and clothing, footwear & personal accessories by 0.6%. Spending on food and at cafes, restaurants and takeaways also rose marginally at 0.2% and 0.5% respectively.

Overall, the increase in spending over the month, at 0.2%, was very subdued and will give the RBA board at the very least a discussion point in support of a pause to monetary policy tightening in April.

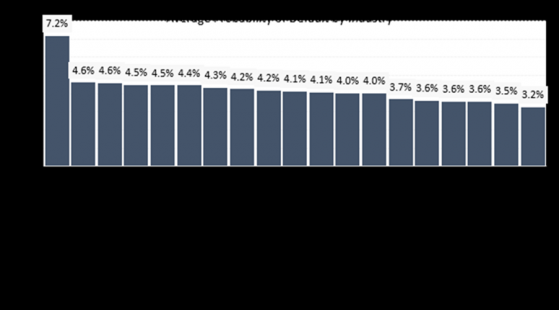

The data reflects CreditorWatch risk metrics, which continues to place those industries which rely on discretionary spending at the top of the table in terms of probability of default.

While we are yet to see a marked downturn in spending at cafes and restaurants, the upcoming winter could tell a different story as more Australian borrowers come off fixed rate loans and many household budgets will see a dramatic fall in excess money available for eating out.

Source: CreditorWatch BRI February 2023

Late payments hit SMEs

One of the unfortunate consequences of belt-tightening are late payments, an issue that largely affects small business the most.

Business loan comparison site Small Business Loans Australia surveyed 210 owners and senior decision-makers across the full SME spectrum and found late customer payments are negatively impacting 64% of SMEs, 15% of SMEs struggle to pay employees when payments are late and 35% expect a higher rate of late payments this year.

It means that with even more stringent spending and cost-cutting, businesses are still at risk of financial hardship if their customers fail to pay on time.

The full survey results, including breakdowns across business sizes and states, can be found here: https://smallbusinessloansaustralia.com/late-customer-payments/

Late customer payments were reported to have a negative effect on the following for SMEs:

- Business owners’ salary.

- Cash flow to pay supplier invoices.

- Staff salaries.

- Ability to pay business purchases.

- Size of workforce.

- Payments on business loans.

- Business credit score.

Almost a third (30%) of medium-sized businesses occasionally struggled to pay their staff due to late customer payments, closely followed by 27% of small businesses and 8% of micro-businesses (which tend to have significantly less employees).

Considering there are 2.4 million SMEs in Australia that employ more than 7.4 million workers and generate more than $700 billion of the economy’s output, this is cause for concern for many of the Australian workforce.

Alon Rajic, founder and managing director of Small Business Loans Australia, said: “With so many economic risks on the horizon, it is a concerning time for small business owners – who need to forecast their cash flow for the 2024 financial year.”

Five at five

Horizon Minerals plans 20,000 metres of exploration drilling across core gold assets

Horizon Minerals Ltd (ASX:HRZ) is continuing to advance its large-scale multi-element new discovery and project generation exploration program across its 1,100 square kilometres tenement package in the Kalgoorlie and Coolgardie regions of Western Australia.

Read more

Terra Uranium active in Athabasca Basin with winter RC drill core now at the lab; diamond drilling on horizon

Terra Uranium Ltd (ASX:T92) has wrapped up the winter reverse circulation (RC) drilling stage of its ongoing maiden exploration program seeking major uranium deposits under cover at the 100%-owned Pasfield and Parker projects in Canada.

Read more

Noxopharm reveals proprietary mRNA vaccine enhancer technology

A collaboration between Noxopharm Ltd (ASX:NOX), a biotech company focused on cancer and inflammation, and the Hudson Institute of Medical Research has produced a novel ‘vaccine enhancer’ called SOF-VACTM.

Read more

Sarytogan Graphite taps global engineers to lead pivotal graphite PFS

Sarytogan Graphite Ltd (ASX:SGA) has recruited world renowned engineering and marketing talent to lead a pre-feasibility study (PFS) into its namesake graphite play in Central Kazakhstan.

Read more

Helix Resources sees promising copper results at Canbelego JV ahead of resource update

Helix Resources Ltd (ASX:HLX) has unearthed new high-grade copper hits ahead of a resource update at the Canbelego joint venture project in central New South Wales.

Read more

On your six

Brookfield Asset Management (TSX:BAM.A) consortium clinches A$18.7 billion takeover of Origin Energy in move to shift away from fossil fuels

After months of delays, Brookfield Asset Management Inc and its consortium of buyers have reached an A$18.7 billion (US$12.4 billion/C$17 billion) deal to buy Australian utility giant Origin Energy Ltd (ASX:ORG).

Read more

The one to watch

Podium Minerals "sees huge opportunity to introduce new PGM jurisdiction to the world"

Podium Minerals Ltd (ASX:POD) managing director and CEO Sam Rodda speaks to Thomas Warner from Proactive about the work he's doing to advance the Parks Reef Project - a 5E platinum group metals (platinum, palladium, rhodium, iridium and gold) deposit which also contains base metals (copper, nickel and cobalt) mineralisation.

Watch

Read more on Proactive Investors AU