Contrary to expectations before the bell, the ASX has risen today. At around 2:30 this afternoon it had gained 46.10 points or 0.64% to 7,297.30, setting a new 20-day high. It closed at 38.40 points or 0.53% up to 7,289.60.

Over the last five days, the index has gained 2.35% and is currently 3.67% off of its 52-week high.

Healthcare was the best performer, with stocks rising around 2% thanks in part to a strong performance from large cap CSL Healthcare, while Consumer Staples was close behind (1.57%) on the back of strong interest in Woolworths (1.6%) and Coles (1%).

The Energy (-0.67%) and Materials (-0.51%) sectors were in the red.

Jobs data out soon

The outlook for this week remains focused on the Australian jobs market, with the latest jobs data to be released on Thursday.

In April, employment fell by 4,300 and the jobless rate rose from 3.5% to 3.7%. The keen attention on these figures stems from a view that the jobs figures are usually the last domino to fall in the recession game.

With our friends across the ditch in New Zealand entering a technical recession – defined by two quarters of negative growth – there is growing acceptance among economists that we’re next, with the odds now even, or better, that we’re about to enter a recession.

Weakening figures on that front may point the way to not only the Reserve Bank’s next move but our proximity to economic stagnation.

The RBA is among several to use the unemployment figures to define a recession ahead of movements in GDP.

Will Blinken meet Xi?

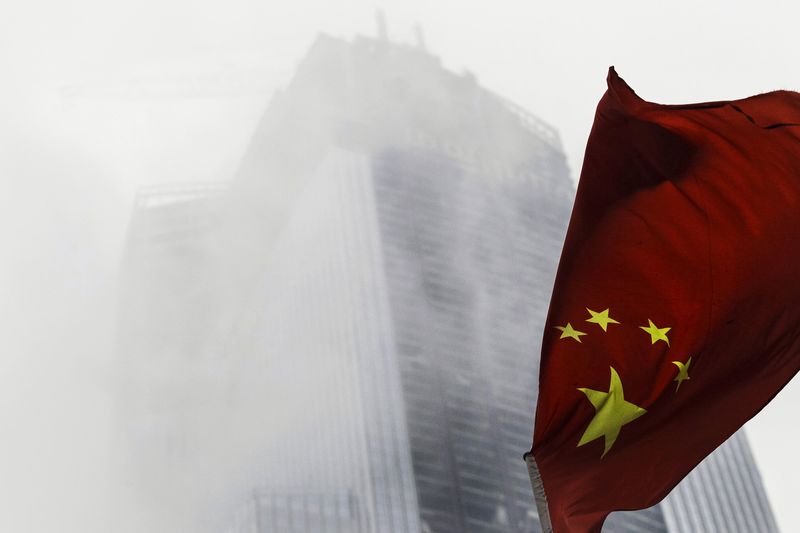

Meanwhile, eyes will be on the world’s two biggest economies with US Secretary of State Antony Blinken in Beijing for high-level meetings aimed at stabilising relations.

Blinken wrapped up a meeting with China's top diplomat, Wang Yi, with both sides entering talks aimed at improving their strained relationship, which has been exacerbated by China's close ties with Russia and US efforts to restrict advanced technology sales to China.

It remains to be seen whether Blinken will now meet the Chinese leader Xi Jinping during the visit.

The five at five

Predictive Discovery (ASX:PDI) readies for gold resource update and regional drilling at Bankan

Predictive Discovery Ltd (ASX:PDI, OTC:PDIYF) has welcomed the latest round of drill results from its tier-one Bankan Gold Project in Guinea, where it’s exploring for precious metal mineralisation across the NE Bankan, Bankan Creek and Arlo gold targets.

Read more

Lanthanein Resources wraps up high-grade REE drill campaign at Lyons

Lanthanein Resources Ltd (ASX:LNR) is seeking another breakthrough at its Lyons Rare Earths Project in Western Australia after completing a 9,635-metre reverse circulation (RC) drill program aimed at discovering high-grade rare earth (REE) mineralisation.

Read more

Ionic Rare Earths gives old rare earth magnets a second chance at Belfast recycling facility

Ionic Rare Earths Ltd (ASX:IXR, OTC:IXRRF) is turning trash into critical minerals treasure after flipping the switch on rare earth oxide production at its Belfast recycling facility in the UK. The production line will transform magnets from end-of-life wind turbines and electric vehicles into high-purity magnetic rare earth oxides, priming these minerals to re-enter the green energy market.

Read more

Resource Mining Corporation kicks off maiden drilling at Tanzanian nickel project

Resource Mining Corporation Ltd (ASX:RMI) has kicked off its maiden 2000-metre reverse circulation drill program at the Liparamba Nickel Project in Southern Tanzania. The program is targeting a two-kilometre-long 'Southern Corridor' that was identified in recent work by the company and previous exploration work by BHP/Albidon.

Read more

Yandal Resources acquiring key gold structure from Gordons to Kanowna Belle mine

Yandal Resources Ltd (ASX:YRL) is confident of enhancing its gold standing in WA's Goldfields after acquiring the rights to a tenement that covers a significant interpreted structure extending south from the Gordons Project towards Kanowna Belle.

Read more

On your six

Appetite for emerging markets grows as US-China rivalry escalates

The escalating US-China rivalry is stimulating international investors' appetite for emerging markets, says deVere Group CEO and founder Nigel Green.

Read more

The one to watch

Brightstar Resources marches toward production at Menzies

Brightstar Resources Ltd (ASX:BTR) MD Alex Rovira tells Proactive the company has started drilling at the Menzies Gold Project as it strives to increase its 965,000-ounce gold bounty in the Leonora region of Western Australia’s Eastern Goldfields.

Watch