The ASX is down today, weighed down by iron ore miners.

The S&P/ASX200 dropped 99.80 points or 1.43% to 6,895.00, setting a new 50-day low. Over the last five days, the index has lost 3.01% and 5.48% over the last 52 weeks.

Bottom-performing stocks in this index are Novonix Ltd (ASX:ASX:NVX) and Liontown Resources (ASX:LTR) Ltd, down 9.82% and 8.64% respectively.

BHP (ASX:BHP) Group Ltd (LSE:BHP, ASX:BHP) was down 0.81% to $43.04 while Fortescue Metals Group (ASX:ASX:FMG) Ltd slid 2.19% and Rio Tinto Ltd (ASX:RIO) slipped 0.73%.

According to Bloomberg, the decline of iron ore came after Chinese regulators renewed warnings to companies against hoarding and price gouging in response to a recent surge in the steel-making material.

Bloomberg reports “The National Development and Reform Commission summoned iron ore traders and will study regulatory and supply measures to curb ‘unreasonable’ rises. The new warning follows recent efforts by Beijing to tame prices, which closed at a nine-month high last Wednesday.”

Citi analysts maintain a neutral to bearish stance on iron ore’s outlook, attributed to uncertainty around the strength of China’s economic rebound and its belief that steel consumption, especially from the property sector, will stay subdued this year.

"Iron ore has traded in a tight range between $120 and $130 per ton supported by seasonal activity pick up as well as investor's expectations of stimulus from the National People's Congress (China) meeting held in the 1st week of March," the note from Citi states.

The analyst says "headwinds persist and economic recovery is likely to be uneven".

"We suggest selling iron ore into further rallies as steel outlook for this year remains subdued as well as further price rally risks policy intervention."

3 things to watch for the week ahead

eToro market analyst Josh Gilbert shares his three things to watch in Australia in the coming days.

1. RBA Meeting Minutes

This week, the RBA hands down its meeting minutes from its most recent monetary policy decision, where the central bank raised its cash rate by another 25 basis points. This will be the key focus for Aussie investors this week after the RBA’s recent dovish change in language.

In its recent statement, the board avoided plural references like ‘months’ and ‘increases’, instead opting to say ‘further monetary policy tightening will be needed’, which is likely to mean the end of its tightening cycle could be in sight.

Although the minutes are unlikely to reveal anything groundbreaking, they should give further insights into the RBA’s intentions.

It will also be interesting to see the board's comments around Inflation, Retail Sales and Unemployment data, given we have started to see the economy cool in the last four weeks.

Again, these minutes are unlikely to considerably impact the local market but watch for any further signs of dovish comments.

2. Fed Rate Decision

The biggest risk event of the week (March 23) will be overseas, where the Federal Reserve has a huge rate decision on its hands.

Before last week’s wild week in the financial sector, markets were all but certain that the Federal Reserve would raise its cash rate by another 50bps after Jerome Powell’s hawkish comments. Now, markets believe there is a 25% chance that the Fed will pause and leave interest rates unchanged.

Interestingly, all of this is unfolding in the Fed’s blackout period where there is no commentary from board members, making this week's decision even more uncertain. However, what is clear is that this banking crisis has left room for a shorter and less aggressive tightening cycle from the Fed.

The current banking situation will tighten financial conditions and the Fed will not want to aggravate the situation by overtightening.

Last week’s US CPI data showed that the inflation fight still isn’t over, so although the Fed has a difficult decision, a 25 bps hike seems to be the right route in scoring the balance between fighting inflation and not overtightening.

This will likely be a positive for risk assets, with investors feeling they can take on more risk exposure with this jumbo hiking cycle likely coming to an end.

3. Tencent Earnings

It's been a tough couple of years for Tencent shareholders, with shares falling by more than 40% at the hands of China’s harsh tech crackdown. But, the last six months have shown promise, with shares climbing 20% as authorities offer a more relaxed approach. This week the tech giant will hand down earnings, its first set of results following China’s decision to abandon its Zero-COVID Policy.

Given the recent optimism around Chinese tech, it feels as if there may be a change in the tide, with authorities taking a more positive approach and the focal point for investors from these earnings will be the company's full-year outlook.

Tencent has recently received permission to commercialise 10 new titles since late September, a massive win for Tencent after a long wait for approvals from the regulator.

Although investors have plenty to be hopeful for with Chinese tech, risks still remain on future crackdowns and regulatory scrutiny. Tencent’s earnings this week could be a key proxy for broader Chinese tech and what lies ahead in 2023.

What is the Fed to do?

Principal Asset Management chief global strategist Seema Shah looks further into the dilemma the Fed now faces following last week’s banking debacle.

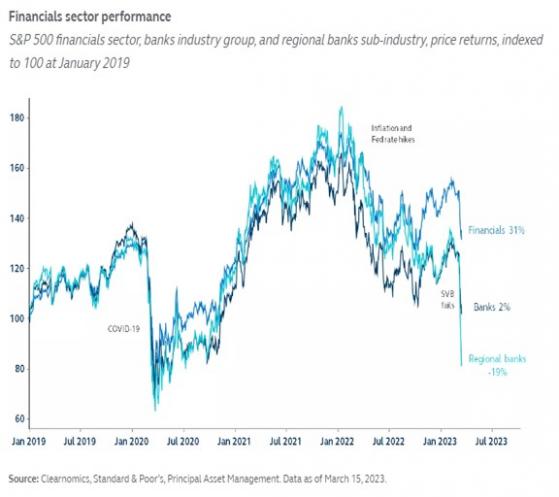

Recent banking sector volatility, coupled with a February CPI report that shows inflation is still running hot, means the Federal Reserve now has a stability dilemma: Cut rates to alleviate market angst and risk spurring inflation higher or, alternatively, persist with aggressive rate hikes to avoid reinvigorating inflation but risk accelerating contagion to the broader financial system.

Their decision to favour either price stability or financial stability will be instructive for the crisis outlook moving forward.

Just over a week ago, a materially more hawkish narrative from Federal Reserve (Fed) chair Jerome Powell at his Congressional Testimony had convinced financial markets that the Fed could revert to a 50-basis point hike in March. However, a wild week of volatility marked by the collapse of three US banks suggests the policy arithmetic for the Federal Reserve has likely changed.

February's CPI Report confirms that the inflation problem is still very present, and, on its own, would likely have cemented a 50-basis point hike at next week’s FOMC meeting.

However, with the recent bank failures sending the financial sector into disarray, and unless the Fed’s new Bank Term Funding Program (a lending facility which will provide additional funding to banks that run into liquidity problems) can successfully sooth market angst, the Fed will likely need to put extra focus on the financial stability side of its mandate.

As a result, a 25-basis point hike is the most likely outcome from the FOMC meeting next week. If market turmoil deepens over coming days, even a pause is possible.

Ultimately, financial conditions will tighten further—either via additional central bank tightening as they try to tame inflation or via a deterioration in the current banking crisis. High-quality, defensive assets should be sought out, while diversification will be increasingly important in the volatile period ahead.

Five at five

Aldoro Resources in "transformational" deal to acquire heavy rare earths project in Namibia

Aldoro Resources Ltd (ASX:ARN) has executed a binding agreement to acquire an 85% interest in the Kameelburg Heavy Rare Earth Carbonatite Project in Namibia, a deal described by the company as "transformational".

Read more

Evolution Energy Minerals captures Chilalo’s graphite opportunity in robust DFS; shares jump

High margins, low capital costs and development-ready assets are the holy trifecta for companies wanting to bring their projects into production and luckily for Evolution Energy Minerals Ltd (ASX:EV1), it seems the Chilalo Graphite Project in Tanzania ticks all three boxes.

Read more

Celsius Resources enters binding deed with local Filipino companies to progress MCB Project

Celsius Resources Ltd (ASX:CLA, AIM:CLA), through its wholly-owned subsidiary Makilala Holding Ltd (MMCI), has inked a deal with Sodor Inc for the latter to acquire 60% of MMCI.

Read more

Ionic Rare Earths DFS confirms technical and financial viability of magnet and heavy rare earths project

A definitive feasibility study (DFS) for Makuutu Rare Earths Project in Uganda has demonstrated the technical and economic viability of a magnet and heavy rare earth element (REE) focused project, in which Ionic Rare Earths Ltd (ASX:IXR, OTC:IXRRF) holds a majority interest.

Read more

Tietto Minerals ramps to full gold production ahead of resource update; DFS forecasts 200,000 ounces annually

Tietto Minerals Ltd (ASX:TIE) has finished process plant commissioning at its 100%-owned 4.5 million tonnes per annum Abujar Gold Mine – West Africa’s newest gold mine – in Côte d’Ivoire and is ramping up to full production.

Read more

On your six

Open AI’s GPT-4 demonstrates “human-level performance” on professional and academic benchmarks

ChatGPT's parent company Open AI has exhibited “human-level performance” in its GPT-4 model, a large multimodal model that aced on several professional and academic benchmarks.

Read more

The one to watch

Neuren Pharmaceuticals hails FDA approval for trofinetide

Neuren Pharmaceuticals Ltd (ASX:NEU) CEO Jon Pilcher speaks with Proactive following the news that its North America partner Acadia Pharmaceuticals has received US Food and Drug Administration approval of DAYBUE™ (trofinetide) for the treatment of Rett syndrome in adult and paediatric patients.

Watch

Read more on Proactive Investors AU