Fenix Resources Ltd (ASX:FEX) has signed a binding agreement with Sinosteel Midwest Corporation securing the exclusive right to mine and export up to 10 million dry metric tonnes of iron ore from the high-grade Beebyn-W11 iron ore deposit in the Weld Range.

The Beebyn-W11 iron ore deposit, which has a total mineral resource estimate (MRE) of 20.5 million tonnes at a grade of 61.3% iron, is situated only 20 kilometres from the company’s mining operations at the Iron Ridge Iron Ore Mine.

This allows for significant operational synergies for future mining activities and uses the company’s existing infrastructure and regional transport and logistics capabilities.

Sinosteel Midwest Corporation is part of the Sinosteel Group, a Chinese State Owned Enterprise ultimately controlled by China Baowu Steel Group, the world’s largest steel producer.

Looking ahead, Fenix intends to immediately progress the required approvals with the expectation that mining activities will kick off at Beebyn-W11 during 2024.

“Exciting growth path”

Fenix chairman John Welborn said: “From the inception of Fenix’s production from Iron Ridge, Sinosteel have been a valued partner both as an off-taker and a provider of infrastructure.

“I am delighted to be expanding our mutually successful partnership with this important right-to-mine agreement.

“Fenix is committed to an exciting growth path to expand our high-grade, high-margin mining operations in the Mid-West.

“Our unique road, rail and port infrastructure and capabilities provide an advantage which enables the efficient monetisation of high-quality regional deposits which for too long have been stranded.

“We are delighted to have secured this initial 10 million tonne right to mine opportunity with Sinosteel and look forward to working with them in partnership to unlock the immense value in their extensive iron ore holdings in the Mid-West.

“Fenix’s operations in the Mid-West, following the strategic consolidation of our haulage business and the acquisition of Mount Gibson’s port and rail infrastructure, have significant scale potential.

“Our strategic intent is to expand our resource inventories, maintain the quality of our operations, and materially boost production to enable cost reduction and the generation of strong profit margins to reward our shareholders.”

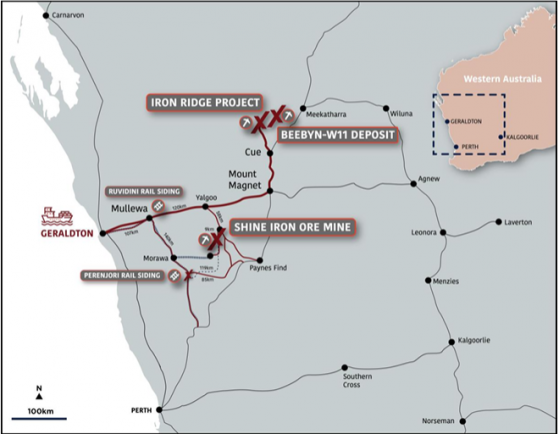

Fenix’s assets in Western Australia’s Mid-West region.

Significantly increases Fenix’s portfolio

This transaction significantly increases Fenix’s portfolio of Mid-West iron ore projects with mineable, attributable mineral resources, which includes the Iron Ridge Iron Ore Mine, the Shine Iron Ore Mine, and the Beebyn-W11 iron ore deposit.

Fenix has demonstrated an ability to rapidly and successfully develop a Weld Range direct shipping ore project into production and has the advantage of existing highly efficient, in-house mining, haulage and port capabilities.

Securing the 10 million tonne right to mine from the high-grade Beebyn-W11 iron ore deposit follows the company’s acquisition of Mount Gibson’s Geraldton Port infrastructure and the consolidation of the Fenix-Newhaul business, with Fenix targeting growth in iron ore production as well as further cost reductions from economies of scale.

The Right to Mine agreement continues the strong partnership between Fenix and the Sinosteel Group and provides scope for the parties to investigate further opportunities to monetise high-value projects within the vast resource-rich Mid-West region.

Transaction summary

The acquisition costs $1 per tonne plus a base royalty and a variable profit share royalty.

Cash consideration of $10 million to be paid as $5 million cash on signing and $5 million cash upon receipt of approval of a mining proposal for Beebyn-W11.

Fenix will maintain exclusive sole control of all mining, hauling, logistics and port operations relating to the mining and export of 10 million dry metric tonnes of iron ore.

About Sinosteel

The Sinosteel Group is one of the biggest suppliers of raw materials to Chinese steel mills and is committed to responsible and sustainable development.

Following the acquisition of Midwest Corporation in 2008, SMC has been actively exploring and developing iron ore opportunities from one of the largest land holdings in the expanding Mid-West resources region of Western Australia.

SMC’s Weld Range Project, including the identified iron ore deposits at Beebyn and Madonga, has long been expected to be a catalyst for major infrastructure development in the Mid-West.