As the fall-out from last week’s Federal Budget continues, it is becoming clear that there was little in the speech (or the associated small print) to either delight or trouble investors writes Mark Chapman, director of tax communications at H&R Block.

The main headline move was the cut to personal tax rates which is due to be implemented from July 1, 2024, and which we have known about since January, courtesy of the Prime Minister’s pre-announcement.

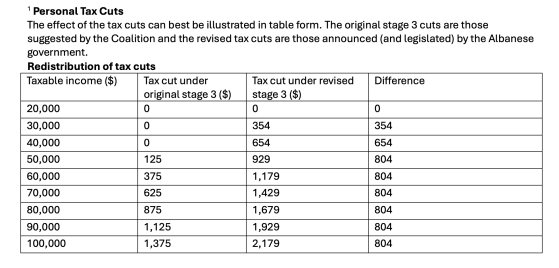

All 13.6 million taxpayers will get the tax cut. These replace the original Stage 3 tax cuts legislated by the former government.

The tax cuts will put more money into the pockets of taxpayers, especially low- and middle-income taxpayers and provide welcome relief from the surging cost of living.

Key features include:

- A cut in the 19% tax rate to 16%, saving $804 for those on taxable incomes of $45,000.

- A cut in the 32.5% rate to 30% for incomes between $45,000 and $135,000.

- Retaining the 37% rate but increasing the threshold for it to apply to $135,000.

- Retaining the current 45% tax rate but increasing the threshold to $190,000.

As originally designed by the Liberal/National government, the tax cuts delivered most of the benefit to those on high incomes. So, nothing at all for people earning $40,000 and only $875 for people earning $80,000. This has now been rectified – people earning $40,000 will get a tax cut of $654 and people earning $80,000 will get a tax cut of $1,679.

With the cost of living disproportionately impacting low- and middle-income taxpayers, this will provide some much-needed extra cash in the pockets of hard-working families to pay mortgages, food and fuel bills.

Taxpayers don’t need to do anything to get the tax cut. Employers will automatically adjust the amount of tax they take out of your pay which means employees should see an immediate increase in take-home pay from July 1, 2024 (1).

Other measures

Apart from the tax cut, there isn’t much of specific interest to investors, at least with regard to taxes.

The ATO is getting more money to deal with taxpayer non-compliance, which will make it harder than ever to avoid the gaze of the taxman, particularly if you’ve got something to hide! Measures include:

- $78.7 million for upgrades to information and communications technologies to enable the ATO to identify and block suspicious activity in real-time.

- $83.5 million for a new compliance taskforce to recover lost revenue and intervene when attempts to obtain fraudulent refunds are made.

- $24.8 million to improve the ATO’s management and governance of its counter-fraud activities, including improving how the ATO assists individuals harmed by fraud.

The Government will also strengthen the ATO’s ability to combat fraud by extending the time the ATO has to notify a taxpayer if it intends to retain a business activity statement (BAS) refund for further investigation. The ATO’s mandatory notification period for BAS refund retention will be increased from 14 days to 30 days to align with time limits for non-BAS refunds.

Finally, the government will amend the tax law to give the ATO the discretion to not use a taxpayer’s refund to offset old tax debts, where the Commissioner had put that old tax debt on hold prior to January 1, 2017.

This discretion will apply to individuals, small businesses and not-for-profits and is undoubtedly aimed at heading off the recent bad headlines around so-called “robo-tax”, which has seen the ATO automatically offsetting refunds against those old debts, including debts up to 20 years old which the taxpayers had long since forgotten existed.

Read more on Proactive Investors AU