Aptos, the much-hyped, venture-backed blockchain project has just dropped, and reception has so far been mixed.

It has been a bumpy ride for Aptos, which has its roots in the one-time Facebook-owned Diem stablecoin project.

But Aptos' launch also comes as an interesting time.

Mainnet has arrived.https://t.co/wZajVZMa5Q— Aptos (@AptosFoundation) October 17, 2022

With few major projects being released since the 2021 goldrush, and the crypto market stuck in a seemingly eternal winter, the blockchain’s launch has many eyes trained on it.

Let’s get the lowdown.

Carpe Diem

Aptos has its roots in the Diem stablecoin project, which had its roots in Facebook (NASDAQ:META) (before the Meta rebrand).

Facebook was forced to abandon Diem following intense regulatory scrutiny, which caused PayPal (NASDAQ:PYPL), Visa (NYSE:V), Mastercard (NYSE:MA), and all other major project partners to jump ship.

Officials in the US were rightfully concerned about Facebook’s financial services plans, considering the social media cum metaverse giant’s chequered history with data privacy.

Federal Reserve chair Jerome Powell voiced his concerns, Zuckerberg cut his losses and Silvergate Bank swooped in and bought Diem’s intellectual property for US$200mln.

But former Facebook/Meta employees Mo Shaik and Avery Ching were not ready to abandon the project.

Diem reappeared in early 2022, bringing with it US$200mln in venture backing from Andreesen Horowitz, Coinbase (NASDAQ:COIN), FTX and a range of others, as well as a new name: Aptos.

A series of testnets later and the project that first sprouted in the depths of Facebook's engineering department has finally seized the day.

After all this time, is it a success?

Off to a slow start, literally

The Aptos blockchain is currently ticking over at 25.35 transactions per second (tps).

Many Twitter users have baulked at such a low throughput- a supposed Solana killer with a tps barely 1% of Solana.

Aptos is broken.Aptos launched today - October 17, 2022 at 14:22:40

However, Aptos is currently has a lower tps than Bitcoin and a majority of tokens are either staked or ready to be dumped on retail investors.

Curious? Thread Below

— Paradigm Engineer #420 (@ParadigmEng420) October 17, 2022

But Aptos’ tps has been steadily increasing throughout the day, having only started at a measly 4tps, so it could simply be teething issues.

The bigger concern could be the current state of the APT coin.

APT received immediate listing support from most major centralised exchanges, including Binance, FTX and Coinbase, but price action has so far been fairly muted.

At the time of writing, APT is down over 42% after launching just yesterday. Far from the worst token launch ever, but certainly not the behaviour expected of a much-hyped new cryptocurrency, especially one with so much venture capital behind it.

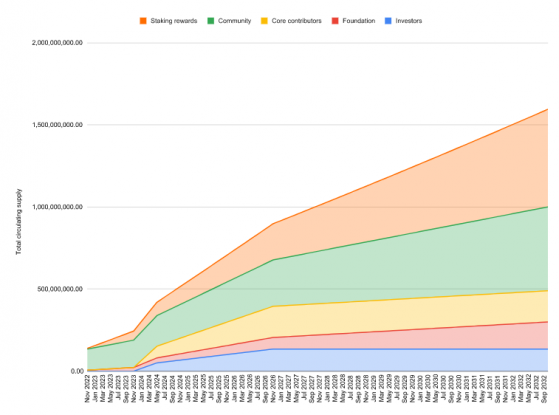

Concerns have also been raised over APT’s tokenomics, with some people criticising the number of tokens reserved for private investors and the centralised Aptos Labs enterprise.

In fairness, investor tokens are subject to a four-year vesting schedule, so short-term token dumping is unlikely to occur.

Vesting schedules are used to combat mass token dumping – Source: aptosfoundation.org

But the criticism runs deeper than that- for crypto heads, any degree of centralisation or private token allocation is frowned upon, if not outright condemned.

Aptos does have one major benefit over Solana: An as yet untarnished security reputation.

In a year when Solana may have experienced one hack too many, perhaps security could prove to be Aptos’ killer app.

Fruits of Aptos’ labour

A little-known lending protocol called Apricot Finance just increased its trading volume by over 3,000% in a day, despite having no hype, upgrades, or notable increase in total value locked on the protocol.

What does that have to do with Aptos?

In a case of ticker confusion, Apricot Finance shares the same APT abbreviation as Aptos on Gate.io and a number of low-tier exchanges.

The few APT holders (of the Apricot Finance persuasion) who saw their tokens nearly triple in price of US$0.004 to the princely sum of US$0.011 must be worshipping the Altar of Aptos Labs right now.

Read more on Proactive Investors AU