When you think of famous triangles, a few examples spring to mind.

There’s the Bermuda Triangle, a deadly urban legend rumoured to terrorise ships navigating the North Atlantic, or the Great Pyramid of Giza, an emblem of early human engineering and an ancient wonder.

The monument (and mystery) has garnered global interest for years, but there's a new triangle coming to the fore — and it’s home to one of the world’s pre-eminent battery metals.

In this article:

- White gold

- Xantippe’s portfolio

- Technology & partnerships hold the key

- The bottom line

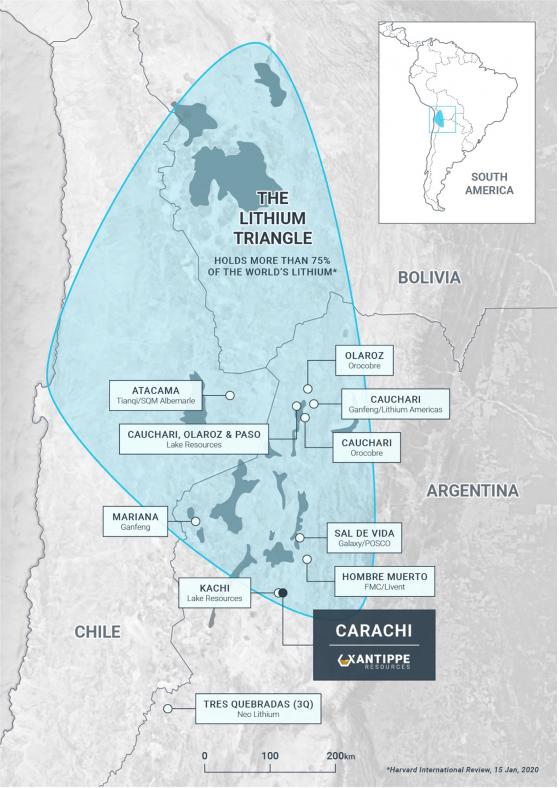

Argentina, Bolivia and Chile make up the ‘Lithium Triangle’ — a region home to the world’s largest concentration of lithium brines, where saline groundwater (rich in dissolved lithium) accumulates to form a concentrated solution.

In fact, the Lithium Triangle is so saturated that it’s estimated to host more than three-quarters of the world’s lithium.

So, who’s on the scene at this giant opportunity? Enter Xantippe Resources Ltd (ASX:XTC, OTC:XTCPF): an ASX-lister that’s exploring the heart of this iconic lithium district.

Famous neighbours in the Lithium Triangle. Source: Xantippe Resources.

Central to its vision is the flagship Carachi Project — a lithium brine hub that’s surrounded by industry heavyweights.

At its core, the company’s mission is simple: Xantippe wants to produce sustainable, high-purity, battery-grade lithium, leveraging new technology and local partnerships to get its product to market.

Before we dive into that vision, let’s take a look at the market opportunity.

White gold

Who’s in the market for lithium? The obvious answer is automakers — as electric vehicles (EVs) come to the fore, battery manufacturers are looking for secure supply.

EV sales more than doubled in 2021 and S&P Global reports that 6.5 million vehicles hit the road last year. By 2025, that number is expected to balloon to 10.5 million.

As such, it’s easy to track lithium’s meteoric rise — the battery metal has even been dubbed ‘white gold’ as pricing skyrockets.

In fact, S&P reports that the value of lithium carbonate alone has risen by more than 500% in the past year.

But there’s a problem (and an opportunity): a supply crunch is coming.

Mapping the lithium deficit. Source: S&P Global.

S&P’s Commodity Insights team said that while markets were expanding in the Americas and Australia, soaring prices and a continued lack of supply through 2030 may decelerate the energy transition, threatening EV sales and adoption.

“Despite COVID, EV sales accelerated globally much faster than expected in the past year and went into hyperdrive,” metals pricing director Scott Yarham explained.

“As a result, lithium demand, which is essential for EV batteries, is growing much faster than lithium supply, creating a market disconnect.”

With a supply crunch looming, the spotlight is on companies that are in development and production, poised to bring more battery-grade lithium online at a crucial time.

Xantippe’s portfolio

Xantippe’s lithium story revolves around eight tenements and just under 22,000 hectares of prospective ground in Northern Argentina.

The Carachi Project rubs shoulders with fellow ASX-lister Lake Resources Ltd, which is also exploring and developing lithium brines in the region.

At the start of this year, Xantippe closed in on a lithium-bearing brine zone during a geophysical survey. This buried salar deposit is open at depth and in all directions laterally, meaning it bears promise as an emerging exploration target.

Commenting on the discovery, Xantippe executive chair John Featherby said the finding propelled the company forward “with great confidence” ahead of its maiden drill program.

"The aim is to use this drilling to provide an initial JORC-compliant mineral resource estimate,” he explained.

Xantippe has already submitted its environmental impact assessment (EIA) to the local mining authority in a bid to secure the exploratory drilling permit. Once approval is in hand, the program will kick off straight away.

Managing director Richard Henning detailed the company’s exploration strategy in a video with Proactive last year:

Technology & partnerships hold the key

One key point of difference is Xantippe’s focus on direct lithium extraction (DLE) technology, which can process lithium brines in a faster and more environmentally responsible manner.

The processing tech presents an alternative to evaporation ponds, which require a large land ‘footprint’ and can take upwards of 18 months to harvest the lithium.

There are a couple of key selling points, but for Xantippe, the DLE appeal comes from increased recoveries, a lower pond footprint and better product purity.

The DLE process. Source: Xantippe Resources.

The tech is in development with a team in Korea — down the line, XTC believes it could be a commercial game-changer as it works to bring Carachi into development.

Another big part of the company’s production vision is its in-country partnerships, both with landowners and the local government.

The company embraces a ‘local first’ policy, meaning it’s committed to working with stakeholders on the ground to generate sustainable lithium that benefits the community.

Xantippe has two Argentina-based directors on the board, while local partner Juan Manuel Santos spearheads the company’s relationships. Lithium geologist Jose Luis Gonzalez is based on the ground and leads the company’s exploration team.

Source: Xantippe Resources.

Beyond its lithium interests, Xantippe is also pursuing precious metal opportunities down under.

In 2018, the company acquired a substantial foothold in WA’s Southern Cross region, where it holds roughly 190 square kilometres of ground prospective for gold and lithium-bearing pegmatites.

The multi-commodity explorer will keep the market updated as it pursues both gold and lithium opportunities, so watch this space.

The bottom line

Long-term, Xantippe hopes to bring an abundant lithium source on stream to help navigate a weighty, global supply crunch.

While Carachi has a way to go before it enters development and production, the company is focused on rallying shareholder support now to get the wheels in motion.

Late last year, the explorer announced it would raise up to $20 million in a placement and share purchase plan to support its exploration endeavours.

Back in December, Featherby said the cash injection would welcome new shareholders to the register at a crucial time for the company.

“We believe these additional funds will drive long-term shareholder value,” he explained.

Source: Xantippe Resources.

With more cash in hand and an exploration program on the horizon, Xantippe is poised to expand on its Argentina lithium opportunity in 2023.

Read more on Proactive Investors AU