- Owns major stake in Europe's largest lithium deposit at Cinovec

- Czech group CEZ has a majority stake in the project

- Preparing a definitive feasibility study for Cinovec

The company's blurb describes European Metals Holdings PLC (LON:EMH) (ASX:EMH) as a UK and Australia-listed exploration business focused on developing a lithium and tin project in the Czech Republic.

But this doesn’t quite capture the potential of the business through its ownership of the Cinovec Project, host to the largest lithium resource in Europe and one of the biggest untapped tin deposits in the world.

In other words, EM has a tiger by the tail.

Cinovec is around 60 miles north-west of Prague on the border with Germany.

So, it has ready access to end-users such as carmakers and companies building the latest generation of electric vehicles.

Volkswagen (ETR:VOWG_p)'s decision to locate its first electric vehicle plant at Zwickau, 90km from Cinovec suggests it is in the right place.

Zwickau is due to come on stream in November. VW has also announced a 16Gw battery cell factory will be built in conjunction with green energy group Northvolt.

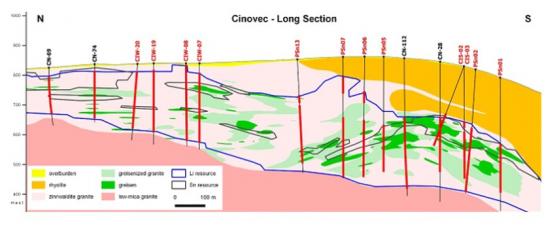

Cinovec is host to an inferred and indicated resource of almost 700mln tonnes at a cut-off of 0.195% lithium and 0.04% tin.

Total indicated resources are 372.4mln tonnes grading 0.45% Li2O and 0.04% tin.

Lithium hydroxide is among the products EME intends to produce.

What's the latest?

European Metals has hired SMS Group Process Technologies as lead engineer at Cinovec.

SMS will be working on the minerals processing and lithium battery-grade chemicals production, to provide a complete Front-End Engineering Design (FEED) study.

The FEED is a key component in the ongoing workstreams for the mine project’s definitive feasibility study.

Under the agreement, SMS will design the full process integration, from the receipt of ore to the underground crusher to the delivery of finished battery-grade lithium chemicals product.

It will encompass both the lithium process flowsheet and additionally a tin/tungsten recovery circuit.

Latest video

What the broker says: Ryan Long, mining analyst at Proactive

"The Cinovec Zinnwaldite Project, has a total JORC 2012 compliant mineral resource estimate of 695.9 million tonnes (mt) at a grade of 1% lithium carbonate equivalent (Li2CO3 E), which makes it the third largest igneous lithium deposit globally, with a contained Li2CO3 E content of 7.2mt.

So CEZ Group is potential acquiring its 51% interest in the project at a value of US$10.3 per tonne (t) of lithium carbonate equivalent in resource.

Inflexion points

- FEED study for Cinovec

- Completion and publication of DFS for Cinovec

- Lithium hydroxide capability confirmed by testwork