European Lithium Ltd (ASX:EUR, OTCQB:EULIF) has entered a binding agreement to acquire the Leinster Lithium Project in Ireland as it continues to build a portfolio of quality exploration projects in highly prospective European lithium provinces.

The binding agreement signed with Technology Metals plc — a UK-based company listed on the London Stock Exchange — will see European Lithium acquire 100% of the issued share capital of Technology Metals’ fully owned subsidiary, LRH Resources, which holds the rights, title and interest in the Leinster Lithium Project.

European Lithium will settle the US$10 million consideration for the acquisition through the transfer of 1,234,568 shares it holds in Critical Metals Corp at a deemed share price of US$8.10 per share.

Expanding in Europe

European Lithium chairman Tony Sage said: “The acquisition shows our commitment to continue expanding in the European lithium sector and illustrates our capability to identify and secure ground in highly prospective lithium provinces, leveraging our world-class exploration and project development expertise, combined with a strong balance sheet.

“This also demonstrates the value of our investment in Critical Metals Corp. As we move forward, we can utilise the investment again and again without depleting our cash reserves.”

European Lithium now holds 67,788,383 ordinary shares in Critical Metals and is the largest stockholder with 83.03% of issued capital.

As of April 19, 2024, and based on Critical Metals’ closing share price of US$8.10 per share, European Lithium’s investment in Critical Metals is valued at US$549,085,902 (A$856.6 million).

Leinster Lithium Project

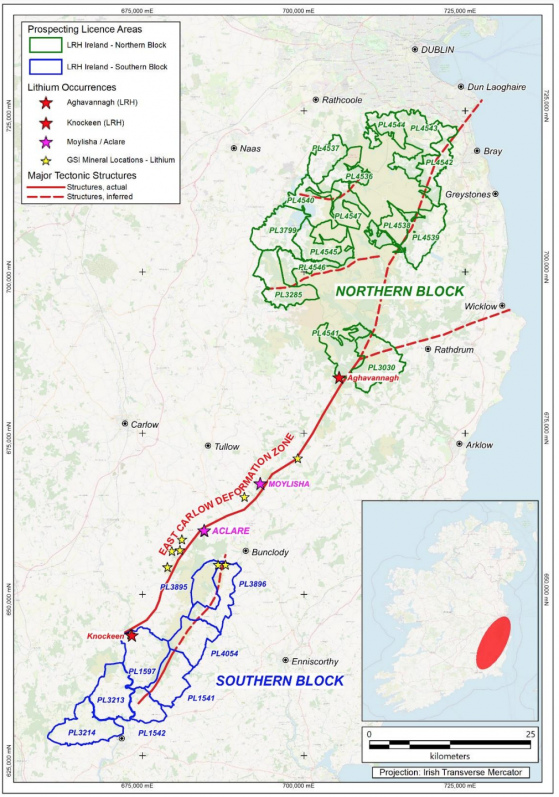

The Leinster Lithium Project is south of Dublin in the Leinster Granite Massif within the same key tectonic zone and along strike to the Blackstairs Lithium Avalonia Project — a Ganfeng-ILC joint venture.

The project is considered to be at the exploration stage of development with significant geological exploration surveys and identification of several developing localised prospect areas.

Spodumene-bearing pegmatites have been located at all of the prospects in surface float material and at one locality in a series of echelon pegmatites forming a closely spaced dike swarm in diamond drilling conducted by the owner in 2023.

The project is subdivided into a North Leinster and a South Leinster Block. The North Leinster Block consists of 15 prospecting licences covering an area of 477 square kilometres. The South Leinster Block, with 8 licences, covers a further 284 square kilometres.

Each block contains several developing prospect areas where significant lithium-bearing spodumene pegmatites have been located in surface sampling and more recently in diamond drilling.

Leinster Lithium Project location and its prospects.

An initial exploration program covering 23 prospecting licences of around 761 square kilometres, demonstrated the presence of 24 intervals of lithium-bearing spodumene pegmatites across nine drill holes with grades up to 2.57% lithium oxide at the project’s Knockeen licence area.

Drilling confirmed a lithium-caesium-tantalum (LCT) pegmatite dike swarm within the East Carlow Deformation Zone, surface assays and trench samples confirmed the range up to 3.75% lithium oxide.

Drilling at Knockeen with spodumene pegmatite intercepts.

Read more on Proactive Investors AU