Prominent oil and gas producer and developer Empire Energy Group Ltd (ASX:EEG, OTC:EEGUF) is making bold strides towards first gas production in early 2025, backed by a recently completed capital raise and ongoing project developments in the Greater McArthur Basin, according to RaaS Research Group.

With the divestment of its US assets and successful equity financing, the company is fully funded for in-ground operations ahead of its Carpentaria Pilot Project, in one of Australia’s most promising gas development regions.

This comes at a time when, as RaaS Research Group puts it: “Quite simply, more gas supply at scale is required for domestic requirements; growing Gladstone LNG ullage; and as a potential supply source for Darwin’s LNG export opportunities.”

As of April 24, Empire Energy, holding a substantial position in the Beetaloo Sub-basin, has raised around A$46.8 million through a strategic mix of equity and royalty sales.

Robust financial position

This financial manoeuvre places EEG in a robust position to push forward with its pilot project, anticipated to commence first gas operations within the first half of 2025.

The capital raised includes A$39 million from an equity issue and an additional A$7.7 million from the sale of a 4.5% Over-Riding Royalty (ORR) across EP187, reflecting a proactive approach to funding and operational readiness.

Empire Energy's forward-looking strategy is evident in its readiness for developmental drilling, slated for August, which will be a key step towards the pilot project's fruition, says RaaS Research Group.

With the Beetaloo Basin's potential as a key player in bridging the expected east coast gas supply shortfall by 2030, Empire Energy’s early moves could set a benchmark in the industry.

“We continue to view EEG as the low-cost, strongly leveraged exposure in the play, with a significant early-mover advantage,” the RaaS report continues.

“The company looks covered from an equity capital perspective to first gas, pending regulatory approvals and debt financing.”

Strong leadership team

Empire’s leadership under managing director Alex Underwood and chair Peter Cleary has been instrumental in navigating the company through strategic divestments and capital management, positioning EEG at the forefront of the Beetaloo play's development.

The company's focus remains on securing all necessary regulatory approvals and finalising gas sales and financing arrangements in the upcoming months.

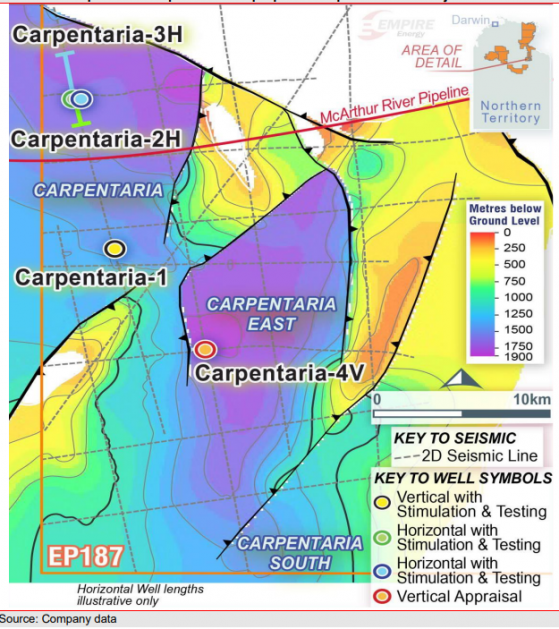

The permit area specific to the proposed Carpentaria Pilot Project.

The recent capital raise not only underscores Empire Energy’s commitment to its project timelines but also strengthens its financial base against potential market fluctuations and regulatory challenges.

With a projected increase in share capital by some 32% following the new issue, EEG looks to maintain its trajectory towards becoming a key player in Australia's gas market, leveraging a first-mover advantage in the Beetaloo Basin.