Elixir Energy Ltd (ASX:EXR) has booked an initial contingent resource for its 100%-owned asset in Queensland, Australia, newly named the Grandis Gas Project – formerly ATP 2044.

Booked initial contingent resources (2C) are in the order of 395 billion standard cubic feet (BCF) of gas, in addition to its gas resources in Mongolia.

The key contingencies of the Grandis Gas Project are the ability to flow gas at sustained commercial rates and the optimum well design.

Independently certified

The contingent resources have been independently certified by international firm ERC Equipoise Pte Ltd (ERCE).

Elixir has two primary targets at the Grandis Gas Project – namely, 1) tight unconventional sandstones and 2) fractured thermally mature coals.

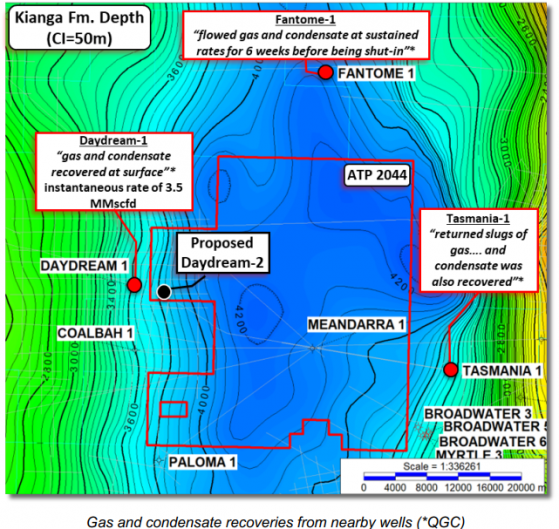

ERCE assigns contingent resources to the tight sandstones of the Permian-aged Kianga Formation and Back Creek Group only, as these are the origin of the gas flows in nearby wells.

The estimation of the contingent resources is based on the results of previous drilling in the same Taroom Trough play, immediately to the west, north and east of the Grandis Project.

The fractured thermal mature coals remain an exploration target and have not been evaluated by ERCE.

Elixir’s technical team has analysed drilling, logging and test data from these wells.

Resource estimations incorporate specific analysis such as:

- seismic interpretation;

- core analysis;

- wireline petrophysics;

- chromatographic gas analysis;

- diagnostic fracture injection testing (DFIT);

- production test analysis; and

- gas sampling.

ERCE has independently reviewed these interpretations.

What a day for a Daydream

Elixir is also planning an appraisal well, Daydream-2, which will be extensively stimulated and tested in order to prove commercial flow rates.

The company is targeting drilling of the Daydream-2 appraisal well in the latter part of 2023.

A project manager has been appointed, rig companies, other service sector companies and adjacent operators have been engaged and initial scoping and well design have kicked off.

Daydream-2’s preliminary location is accessible – it is expected to be around 3 kilometres east of Daydream-1, which was drilled by BG Group in 2011 and flowed gas at an instantaneous rate of 3.5 million standard cubic feet per day (MMscfd).

Establishing flow rates is a key objective for Daydream-2. Elixir hopes that a success case could lead to a material increase in contingent resources in the overall licence area.

Managing director Neil Young said: “Our technical team has done a superb job in working with ERCE to book a very material initial contingent resource for our Grandis Gas Project.

“Location is critical for gas resources, and given this year’s geo-political events, this asset is fantastically well placed, adjacent to existing gas infrastructure that connects to domestic gas markets and via the Gladstone LNG plants, to global gas markets.

“We anticipate drilling the Daydream-2 appraisal well in the latter part of next year and our work activities for all aspects of this are going to plan.”

Read more on Proactive Investors AU