Elementos Ltd (ASX:ELT, OTC:ELTLF) continues to intercept near-surface tin mineralisation as predicted by its geological model and 2021 mineral resource estimate, achieving the stated goals of the drilling program.

The second drill hole (ADD_25) completed in the program returned notable intersections at the margins of the current geological resource:

- 15.8 metres at 0.24% tin from 54.0 metres;

- 5.5 metres at 0.29% Sn from 78.3 metres;

- 2.5 metres at 0.29% Sn from 104.4 metres; and

- 11.3 metres at 0.53% Sn from 108.9 metres.

Working toward higher resource category

“These infill drilling results continue to reinforce the company’s confidence in our geological modelling and understanding of the Oropesa tin deposit,” Elementos managing director Joe David said.

“We continue to intersect mineralisation where predicted by our geological model, bolstering the team’s confidence in the model and our 2021 mineral resource estimate.

“In doing so, our confidence is increasing in achieving the program’s goal of upgrading the inferred mineral resources that reside within the US$30,000/t pit shell, to a higher confidence resource category by the end of the program.”

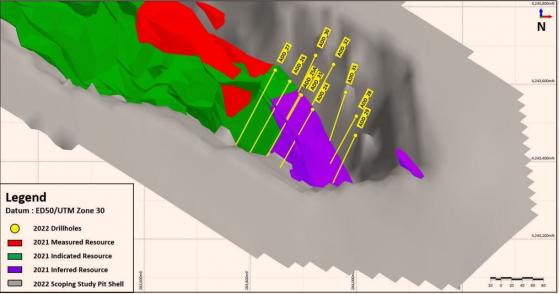

Planned locations of 2022 infill drilling program within the south-eastern section of the 2022 scoping study.

Read more on Proactive Investors AU