Elementos Ltd (ASX:ELT) (OTCMKTS:ELTLF) (FRA:9EM) is seeking to become a major global tin producer to support “an electric tomorrow” with its two wholly-owned world-class tin projects in Spain and Australia.

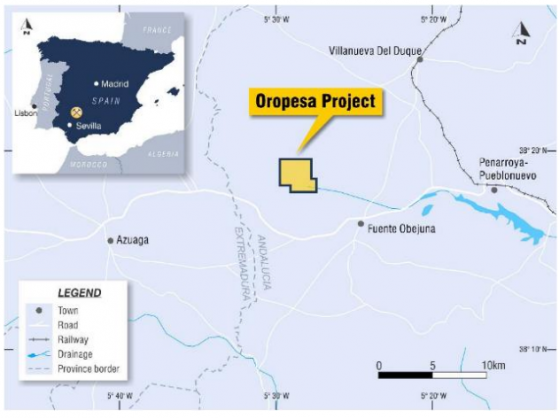

The company has two tin projects – its flagship Oropesa Tin Project in Andalucia, Spain, and its Cleveland Tin Project in Tasmania, Australia - with large JORC resource bases and further exploration potential in mining-friendly (non-conflict) jurisdictions.

An economic study completed in May 2020 positioned the Oropesa Project as a low-cost, globally significant new tin development with a prospective annual production of 2,440 tonnes of tin-in-concentrate over a 14-year mine life.

The company is seeking to further optimise the potential financial returns at Oropesa – one of the world’s largest, undeveloped, open-cut minable tin deposits with access to world-class infrastructure.

Amid surging tin prices, Elementos resumed exploration activities at the Cleveland project in February 2021 to assess the potential for additional tin resources and identify drill targets.

Five value catalysts

The company is embarking on five value catalysts. They are:

- Oropesa Tin Project drilling and program to re-define JORC mineral resource estimate;

- Oropesa feasibility fevelopment programs: On-ground, laboratory and engineering programs to support feasibility study;

- Finalise Oropesa environmental and permitting;

- Feasibility study completion, declare maiden JORC ore reserve, finalise offtake and financing; and

- Unlock value from the Cleveland Tin Project in Tasmania via drilling and engineering development.

Elementos’ exploration drilling program at its Oropesa Project is on track to deliver on its stated goals, with 37 holes completed, one currently underway and six remaining.

The continued confirmation has led to the recent announcement by the company to commence feasibility development programs on the project whilst the drilling program is in its final stages.

New zones of mineralisation have been interpreted and the best results include:

- 3.6 metres at 0.77% tin from 22.9 metres;

- 13.6 metres at 0.32% from 31.5 metres;

- 7.6 metres at 0.53% from 119.5 metres; and

- 1.1 metres at 0.63% from 134.0 metres.

“This data confirms the existence of relatively shallow mineralisation in the middle of the resource and increases the confidence of the previously modelled deeper mineralisation.

“These positive results continue to enthuse the project team, reinforcing their understanding of the geology, the project and its development strategy.”

The company believes Oropesa represents an opportunity to create a value-uplift potential for shareholders as the project is advanced towards development.

It has started feasibility development programs consisting of a series of on-ground investigations, supported by laboratory test-work and engineering studies.

The four key feasibility programs include:

The company said that although the economic study outcomes were positive, there were a number of geological goals identified that had the potential to enhance the project’s economics.

Three key areas of optimisation potential include:

Cleveland co-funded by Tasmanian Government

Elementos was awarded a grant of up to A$70,000 - $50,000 to co-fund direct drilling costs and $20,000 for helicopter support, if required - under the Tasmanian Government’s Exploration Drilling Grant Initiative (EDGI) program.

Its proposed drilling program, which consists of four diamond drill holes for a total of 1,000 metres will test for tin and copper mineralisation along strike and to the northeast of the historical tin mine.

The drilling will test for tin and copper mineralisation along strike and to the northeast of the historical tin mine.

Initial reconnaissance geological confirmation mapping and rock chip sampling in February confirmed the prospectivity of the untested anomalies, which were first identified by a Self-Potential (SP) geophysical survey in 1954.

Four of the five rock chip samples that were collected contained visible sulphide mineralisation with the most significant assay being 0.7% tin, 0.57% copper and 13.4% zinc.

The nature of the mineralisation observed during the reconnaissance fieldwork program is similar to that observed during the 2017 Cleveland diamond drilling program targeted shallow resources above the existing resource.

A standard work program approval application has been lodged with Mineral Resources Tasmania for the drilling program.

Elementos has conducted tendering for work packages and on approval of the works will award the contracted packages and commence the program.

Tin prices near historic highs

Tin prices increased in 2021 on the back of declining stockpiles and strong industrial demand, particularly for semi-conductors and electronics.

Tin spot prices have remained above US$30,000 for nearly two months.

Tin 3-month forward prices remain above historic highs of US$30,000.

The near-term supply gap can only come from new production or an expansion or restart of historic mines.

The global tin demand is steadily increasing as it services the technology revolution, with electronics, communications, IT, renewable energy, and electric vehicles all crying out for more tin.

Further, there are very few low-risk, environmental, social, governance (ESG) projects in the global pipeline, with existing tin mines mostly producing from lower-grade, diminishing reserves.

New supply is limited as potential projects are either high capex underground mines, low-grade open pit mines or located in risky jurisdictions.

Read more on Proactive Investors AU