Element 25 Ltd has returned financial results described as "outstanding" in a feasibility study for the proposed high-purity manganese sulphate (HPMSM) facility being planned for Louisiana, USA.

The proposed facility will primarily supply local fast-growing electric vehicle (EV) markets, with E25 in a position to become the leading US source of HPMSM.

This facility is expected to produce around 67% less carbon dioxide (CO2) compared to competitors in China and 26% less CO2 than the closest non-China competitor's optimised case.

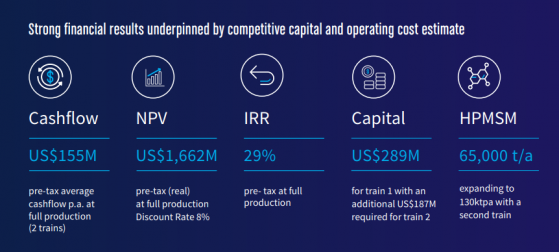

Its scope comprises a production facility capable of producing 65,000 tonnes per year of battery-grade HPMSM per train, with a second train to be constructed in subsequent years.

The strong financial results are underpinned by competitive capital and operating cost estimates, with a 29% pre-tax IRR at full production, pre-tax average cash flow of US$155 million per annum and pre-tax NPV of US$1.662 billion at full production.

Looking ahead, the study provides a compelling base case for future growth, with the strategic plan envisaging multiple HPMSM production facilities globally, while strong support is coming from the local, state, and federal governments.

Financial highlights.

The robust feasibility study has drawn a positive response from investors with E25 shares as much as 11.85% higher in ASX trading intraday to A$0.85.

Study highlights

The purpose of the study is to provide a technical and economic assessment of the development of an HPMSM business utilising E25’s Butcherbird manganese concentrate from Western Australia as feedstock for a facility to produce HPMSM.

It study confirms the feasibility of producing HPMSM at a Louisiana location for sale to local and international offtake partners with an environmental impact that is significantly lower than incumbent producers to supply the rapidly growing electric vehicle supply chain in the United States.

The project is uniquely positioned to benefit from its highly favourable location in Louisiana, USA, with exceptional infrastructure, a deep local talent pool, low-cost energy and proximity to local markets for the repurposing of by-product industrial materials to maximise circular resource use.

Market dynamics

The HPMSM industry is experiencing a period of very strong growth as the industrial world transitions to renewable energy, giving rise to an ever-greater need for energy storage by way of batteries.

HPMSM plays a key role in battery manufacture as a key ingredient in the battery cathode, which is partly driven by technical requirements and partly by economics.

The battery industry is currently reliant on the Chinese production infrastructure which creates undesirable dependencies on a single source.

Supply disruptions relating to HPMSM can have serious downstream impacts on an EV manufacturer as a lack of manganese can mean that battery manufacturing comes to a halt with major impacts on the business.

Read more on Proactive Investors AU