2023 marks another significant year in the electric vehicle (EV) sector's evolution, following a remarkable 62% increase in electric car sales in 2022 compared to 2021. According to IDTechEx, global sales are projected to grow by an additional 16% in 2023.

The growth trajectory in 2023 faced challenges, notably due to the underperformance of plug-in hybrids (PHEVs) in Europe, impacted by subsidy phase-outs in countries like Germany. Nonetheless, the general consensus continues to favour EVs as the future, particularly in the passenger car market.

Electric cars have now become a mainstream concept but the automotive market continues to witness significant technological and market trends.

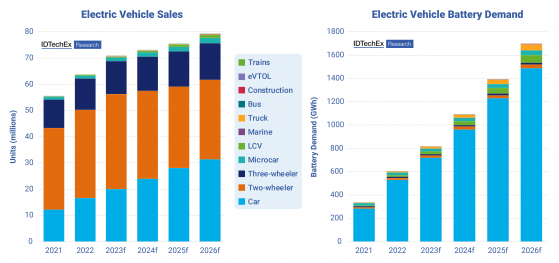

Electrification is not just limited to cars; it extends to various vehicle segments on and off the road, including vans, trucks, buses, two-wheelers, three-wheelers, microcars, construction vehicles and trains.

Furthermore, electrification is making inroads into marine (boats and ships) and aerial sectors (air taxis, eVTOLs), each with unique technological requirements and market dynamics.

Two-fold increase in sales coming

The EV landscape to 2034 is set to evolve moderately, with IDTechEx predicting a two-fold increase in annual EV sales across all segments.

Despite some stagnation in electric two- and three-wheeler sales in major markets, the demand for batteries is expected to surge by more than 7.7 times, largely propelled by the car market, complemented by contributions from other segments.

The automotive landscape is witnessing a shift with technology companies becoming key players in the EV space, exemplified by Tesla (NASDAQ:TSLA)'s transformative approach.

Companies like Huawei, Sony, Xiaomi, Baidu (NASDAQ:BIDU), Foxconn and others are venturing into vehicle production, often in partnership with traditional automakers, blending software expertise with established manufacturing capabilities.

Electric vehicle sales and battery demand to 2026. Source: IDTechEx

Charging infrastructure expands

The EV charging infrastructure is also expanding rapidly. By 2034, IDTechEx anticipates the need for 222 million chargers to support the growing global EV fleet, with an estimated investment exceeding US$123 billion.

China leads the global public charging market, while initiatives like the US's NEVI Formula Program and the EU's Alternative Fuels Infrastructure Regulation drive growth in other regions.

Global charging infrastructure installations. Source: EVCIPA (China), EAFO (Europe), AFDC (US). Compiled by IDTechEx. Data shown as of April 2023.

Keep on truckin'

The electric truck market, although in its infancy in Europe and the US, is gaining momentum with significant investments from major OEMs. The sector is seeing increased model availability and technological advancements, especially in heavy-duty trucks.

In the realm of aerial mobility, eVTOLs are emerging as potential air taxi services. Despite regulatory challenges, significant progress is being made, with many eVTOL OEMs targeting commercial service launch between 2024 and 2026.

Target (NYSE:TGT) timelines for eVTOL companies looking to begin commercial production. Source: IDTechEx chart based on 29 company announcements.

IDTechEx's comprehensive report 'Electric Vehicles: Land, Sea & Air 2024-2044' offers an in-depth analysis of the EV market, covering various vehicle segments and emerging technologies. The report, along with additional resources, is available at www.IDTechEx.com/EV, providing detailed insights into the electrification of multiple vehicle sectors.

Read more on Proactive Investors AU