Nasdaq-listed cryptocurrency exchange Coinbase Global Inc (NASDAQ:COIN) has thrown its weight behind USD Coin (USDC), the stablecoin issued by Circle, in a broadside against Tether, the issuer of the world’s largest stablecoin USDT.

"The events of the past few weeks have put some stablecoins to the test and we’ve seen a flight to safety," Coinbase said in a blog post, adding: "We believe that USD Coin (USDC) is a trusted and reputable stablecoin."

To make the switch from USDT to USDC easier, Coinbase is waiving all conversion fees for global customers.

Coinbase has good reason to tout USD Coin: The exchange is a founding member of the stablecoin’s management group The Centre Consortium.

But there are genuine reasons to consider the switch.

Circle has been particularly diligent in its transparency via monthly attestation reports compiled by global accounting firm Grant Thornton.

These reports do not constitute actual audits, but they do make public the reserves held by Circle.

According to Grant Thornton’s latest attestation report, Circle has US$43.75bn in its reserves against USDC circulation of US$43.5bn, meaning every USDC can be redeemed 1:1 for US dollars.

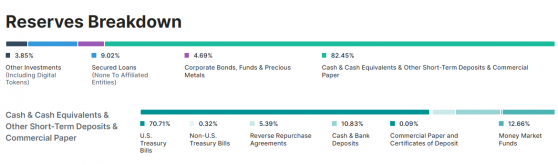

Not all reserves are held in cash: Around 70% is held in cash equivalents i.e. short-duration US Treasury bonds.

Tether controversy

Tether also releases monthly attestation reports supplied by independent auditor BDO, the first of which was only conducted in August of the year. Prior to that, Tether was conducting internal audits.

While all USDT is theoretically backed 1:1, the mix is a little different.

Read more: Tether releases first attestation report by BDO

Approximately 80% of Tether’s reserves are made up of cash and cash equivalents, 71% of which is US Treasury bills and only 11% is actual dollars in the bank.

A further 14% of USDT is backed by secured loans and other investments, which may not be instantly liquid should a bank run occur, and nearly 5% is in corporate bonds, funds and precious metals.

Tether has drastically reduced its dependence on unsecured loans since 2021 – Source: tether.to

Tether’s reserves were the source of a lot of controversy in 2021, when the New York Attorney General ruled that it misled the public on its collateralised position.

Rather than cash or even cash equivalents, USDT was almost entirely collateralised by commercial paper (i.e. unsecured debt).

Tether has sought to reduce its commercial paper holding to zero by the end of 2022, which it mostly has saved for a fraction of a percent.

Despite Coinbase’s announcement, there has been no real decrease in USDT’s market capitalisation, which is currently US$66bn against USDC’s US$43.5bn.

Read more on Proactive Investors AU