There seems to be disagreement over how many active users Decentraland, the Ethereum-based, community-developed metaverse project has.

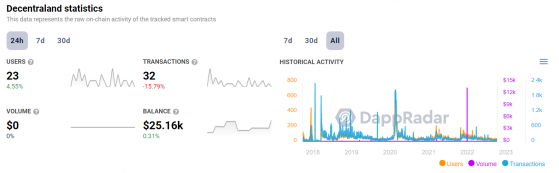

On the one hand, DappRadar presents a measly sum of 23 active users (as of 11am, Monday October 10), with 516 counted over the past 30 days.

Decentraland stats according to DappRadar – Source: dappradar.com

But Decentraland vigorously refuted these statistics, claiming that the game had over 56,000 monthly active users in September.

Let's have a look at some of September's data:56,697 MAU

1,074 Users interacting with smart contracts

1,732 minted Emotes

6,315 sold Wearables

300 Creators received royalties

161 created Community Events

148 DAO Proposals

— Decentraland (@decentraland) October 7, 2022

The company posted a link to another market tracker, the foundation-linked DCL Metrics, which showed an active user count greater than 7,000.

So why the discrepancy? It all comes down to what you consider an ‘active user’.

While DCL Metrics counts the game’s user logins, DappRadar only counts the “number of unique wallet addresses interacting with the dapp’s smart contracts”.

In other words, unless you’re actively buying or selling Decentraland NFTs, you’re not an active user, reckons DappRadar.

Decentraland stats according to DCLm Metrics – Source: dcl-metrics.com

It’s not hard to see the logic behind DappRadar’s metrics though; ultimately metaverses are meant to derive value through NFT sales, and regardless of where you get your data from, there’s no denying that the numbers aren’t great.

Volumes tank in 2022

By Decentraland's own marketplace stats, 112,580 MANA worth of primary and secondary land and wearables sales has been completed in the past seven days, or US$77,000 in fiat terms.

Stretching it out to the past month, the total volume comes to a little over US$373,000.

It’s not just Decentraland in trouble; Meta’s Horizon Worlds, with all the weight of Mark Zuckerberg’s billions behind it, is apparently struggling to get even its own developers to engage with it.

That said, Horizon Worlds' specific user numbers are not readily accessible, so we can’t really be sure, though the much-maligned launch campaign and basic graphics probably haven’t helped.

Decentraland’s closest competitor, The Sandbox, is undoubtedly the more popular of the two, with nearly three times the active user count, higher volumes, and the patronage of Snoop Dogg.

But at US$1.27bn, Decentraland’s MANA maintains a higher market capitalisation, albeit only slightly, against SAND’s US$1.24bn market cap.

That is not to say either is faring particularly well on the market- they have both tanked 80% in value since the start of the year, albeit from eyewatering overvalued positions.

But these are still pretty high valuations for apparently empty metaverses.

All mouth and no trousers

Perhaps the speculative nature of crypto assets is such that the underlying fundamentals are not always correlative to their perceived market value.

Or maybe market cap is the wrong number to look at- SAND’s 24-hour volume is significantly higher than MANA’s after all.

‘Metaverse’ is as much a buzzword as it is a technological evolution, and as we all know, buzzwords are nostrums for market valuations, even if the underlying fundamentals don’t stack up.

Countless metaverse platforms were announced during the NFT boom of November 2021, many with flashy web pages and little else to show.

I can’t think of a single one that has made any dent in the market nearly one year on. But a handful of developers probably made a killing.

Read more on Proactive Investors AU