Cyprium Metals Ltd (ASX:CYM, OTC:CYPMF) is an Australian copper developer and explorer with a portfolio of near-term development projects in Western Australia.

The company is focused on the delivery and execution of its strategy to restart the Nifty Project as a large-scale open-pit copper operation.

Under a newly appointed executive chairman in Matt Fifield, Cyprium is eager to get to work in establishing itself as a strong copper company while creating shareholder value.

Following a challenging couple of years, Fifield is confident of a turnaround, and is of the view that “Cyprium is one of the most undervalued mining companies on the ASX”.

The company, which holds a portfolio of copper assets in mining-friendly Western Australia, is seeking to establish itself as a near-term copper producer, anchored by its flagship brownfield asset — the Nifty Copper Mine.

And with its competent and experienced technical team, Cyprium may just have all the parts needed to do just that.

The Nifty Copper Mine

The Nifty Copper Mine — Cyprium’s flagship project — is on the western edge of the Great Sandy Desert in the northeastern Pilbara, around 330 kilometres southeast of Port Hedland. The company’s primary focus is on developing Nifty to a large open pit mine.

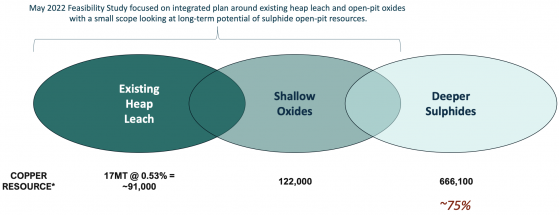

Nifty has a measured and indicated 2012 JORC resource of 788,000 tonnes of copper in its open pit and a historic mineral inventory of 91,000 tonnes of copper in its existing heap leach pads. The sulphide resource is a significant scale opportunity that Cyprium intends to execute in the next few years.

The company clarifies that the long-term opportunity remains its sulphide resource:

Here’s a comparison of contained copper mineral resources at Nifty, Cyprium combined MRE across all projects, and other Australian copper projects:

The mine previously produced significant copper from oxide and sulphide resources. Over the past two years, Cyprium has invested significant time and resources to refurbish the Nifty solvent extraction and electrowinning (SX-EW) plant and build a comprehensive understanding of Nifty’s open pit potential of Nifty’s sulphide orebody.

Now pending, the open-pit study work will allow for further development of commercial frameworks for execution.

Initially, the company will assess a small SX-EW plant restart of around 5,000 tonnes per annum of cathode. It says that recovering copper from the current heap leach materials is the clearest strategic next step.

The operating complexity and capital costs should be very low if the open pit isn’t restarted, and this option can be executed quickly, building off recent investments in site cleanup and utilising existing permits.

This small plant would provide cash flow to sustain the business, grow capabilities and put it in a better position to address long-term potential.

The company highlights Nifty’s advantages of having significant invested capital, data from a long operating history, large-scale resources, current operational approvals and recent investment in the property.

A turnaround in the works

Despite Cyprium’s extensive portfolio of exploration assets and, particularly, the potential of its flagship Nifty project, the company doesn’t hide the fact that it has previously disappointed shareholders.

CYM is down some 96% from its 3-year high. Having exceeded 30 cents per share in May 2021, it is trading below 2 cents in early 2024.

Cyprium provided a snapshot of the reasons why it disappointed shareholders in recent years:

The company relisted on the ASX in June 2023 after entering voluntary suspension in February of that year but has since failed to convince shareholders of its potential.

Seeking to turn around its fortunes, Cyprium completed a $31.6 million capital raise in September 2023 and swiftly made plans to assemble a dream team to execute the restart of its Nifty Copper Project.

It first appointed Matt Fifield to the board, along with highly experienced mining and corporate executive Ross Bhappu.

Upon the later resignation of Clive Donner as managing director, Fifield took up the executive chairman position.

In a shareholder update, Fifield clarified his goals for the company, saying, “we expect to grow our company into a fuller expression of what it can be; a mid-tier ASX copper company with scalable assets in the Paterson and Murchison provinces.”

He also acknowledged management’s prior poor communication with shareholders but says increased communication can now be expected.

Here is a look at the current Cyprium board and key management team:

Other projects

Paterson copper projects

Cyprium’s portfolio of Paterson copper projects comprises not only its flagship Nifty Copper Mine but the Maroochydore Copper Project and Paterson Exploration Project.

The company notes that “refreshed views” are needed on these other assets (Maroochydore, Murchison) but are not high priority at present.

Maroochydore deposit

Around 85 kilometres southeast of Nifty is the Maroochydore deposit, which includes a shallow 2012 JORC mineral resource of 486,000 tonnes of contained copper. Cyprium plans to commence scoping studies targeting development of a +10-year 20,000 to 30,000 tonnes per year copper metal producing leach-SXEW operation.

It intends for this to commence once Nifty is fully developed and achieves stable profitable production.

IGO exploration earn-in joint venture

Cyprium has entered into an exploration earn-in joint venture (JV) with IGO Limited on around 2,400 square kilometres of the company’s Paterson Exploration Project.

Under the agreement, IGO is to sole fund $32 million of exploration activities over 6.5 years to earn a 70% interest in the project, including a minimum expenditure of $11 million over the first 3.5 years.

Upon earning a 70% interest, the JV will form and IGO will free-carry Paterson Copper to the completion of a pre-feasibility study (PFS) on a new mineral discovery.

Murchison copper-gold projects

Nanadie Well Project

The Nanadie Well Project is around 75 kilometres southeast of Meekatharra in the Murchison District of WA. Sitting within mining lease M51/887, the projects include the Nanadie Well copper-gold mineral resources of 162,000 tonnes of contained copper, which is open at depth and along strike to the north.

Exploration will continue to define the scale and potential of this large prospective muti-element geological footprint.

Cue Copper-Gold Project

Cyprium has an 80% attributable interest in a joint venture with Musgrave Minerals at the Cue Copper-Gold Project, which includes the Hollandaire copper-gold mineral resources of 51,500 tonnes contained copper.

Nanadie Well and Cue copper-gold projects are included in an ongoing scoping study to determine the parameters required to develop a copper project in the region. This will determine optimal resource development and exploration work going forward.