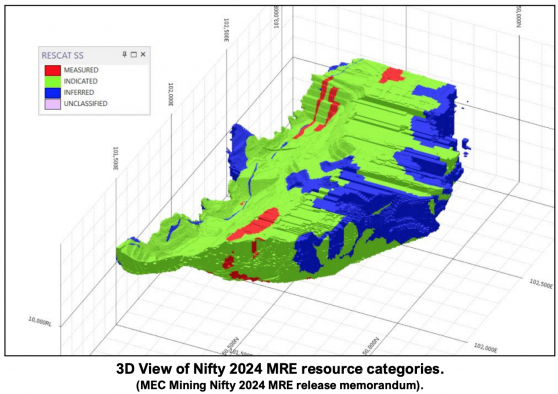

Cyprium Metals Ltd (ASX:CYM, OTC:CYPMF) has opened higher after passing a key milestone with an updated 2024 mineral resource estimate (MRE) for its flagship Nifty Copper Mine asset in Western Australia taking measured and indicated mineral resources to 119 million tonnes at 0.84% copper for 1 million tonnes of contained copper.

Importantly, 95% of the global resource at Nifty is now in the higher confidence measured and indicated categories.

Cyprium shares have opened 36.84% higher on the ASX to A$0.026 and are double the closing price of A$0.013 on March 1, 2024.

“Should support large-scale mine”

The updated MRE incorporates past underground modelling of Nifty and supports Cyprium’s plans for a large-scale, open-cut mine.

“This MRE is the basis for our workstreams to redevelop Nifty into a significant new copper mine. With a million tonnes of contained copper, this resource should support a large-scale mine. This is the long-term opportunity at Nifty,” said Cyprium executive chair Matt Fifield.

“Nifty is one of the largest non-operational copper projects in Australia and the only brownfield project that can be reactivated in short order.

“This update is the result of a disciplined process run by the Cyprium team and MEC Mining. Our objective with this MRE scope was to ensure a strong foundation for our planning work, including pit optimisation and mining studies.

“As a result of the detailed study work, the proportion of the resource categorised as measured and indicated has risen from 80% to 95%, bolstering the project’s feasibility and long-term economic prospects,” said Fifield.

The company says Nifty’s sedimentary-hosted copper resource showcases stable mineralisation patterns, defined by comprehensive drilling and mining activities spanning more than 30 years.

This robust dataset, in conjunction with geological and structural information not included in the previous estimate, provided Cyprium with a better understanding and sharper definition of the deposit and significantly upgraded the resource classifications and its economics.