Cyprium Metals Ltd (ASX:CYM, OTC:CYPMF) has announced a new shortfall agreement with Nebari Natural Resources Credit Fund II, LP, following its $5 million entitlement offer, set to conclude on September 7, 2023.

Nebari Partners, LLC is a United States-based investment manager, specialising in privately offered pooled investment vehicles, including Nebari Natural Resources Credit Fund II, which is funding this transaction.

The growing Nebari team has deep experience with leading global mining companies and financial institutions and the company is known for partnering with motivated and capable management teams, focused on achieving clear goals, supported by technically strong assets.

Shortfall shares

As part of the arrangement, Nebari will subscribe to $500,000 worth of shares, translating to a total of 12.5 million shares at an issue price of $0.04 per share. These shares come with a free attaching option of 1:2 at $0.06 per option.

The company's board has also noted strong interest regarding a significant uptake of the potential shortfall. Shareholders recorded as of August 18, 2023, are entitled to apply for their proportional shares, including any additional allocations, via CYM's official share registry at Automic.

For more details and application processes, shareholders can visit https://investor.automic.com.au/.

“We are very pleased to have our financier, Nebari, a highly respected and experienced financier of mining projects globally, subscribing for $500,000 of shortfall shares in the entitlement offer, proposed managing director Clive Donner said.

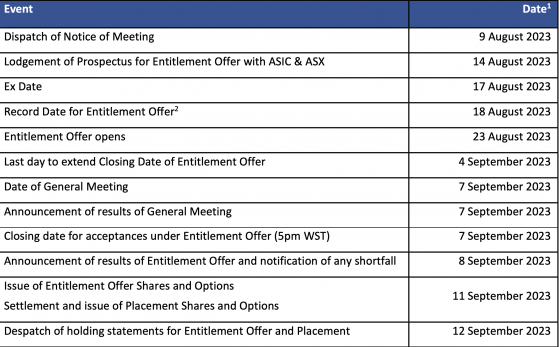

Indicative timetable

Read more on Proactive Investors AU